You can now register for the JobMaker scheme as announced in the Federal Budget back in October.

(Please note that the following are based on draft Rules as announced by the Treasurer)

Please note that according to the draft Rules, if you would like to claim JobMaker for the first period (7 October 2020 – 6 January 2021), you must register on or before 6 January 2021.

What is JobMaker?

JobMaker is a new scheme aimed at supporting employers to employ additional people in their businesses, specifically those aged between 16 and 35 years of age. Employers will get reimbursed for each new employee they hire over the period of 7 October 2020 until 6 October 2021. The hiring credit is then available for another 12 months for each of those new jobs (meaning the scheme is set to come to an end on October 6, 2022).

Employers will receive:

- $200 per week for each eligible employee aged between 16 and 29 years of age

- $100 per week for each eligible employee between 30 and 35 years of age

The credit will be capped at the value of the increase in the total payroll for the JobMaker Period over and above the baseline payroll amount (more on this later).

Am I Eligible?

As an employer, you are eligible to claim the JobMaker you can answer YES to all of the following:

- You are registered for ABN and PAYG Withholding during the relevant JobMaker Period (more on the JobMaker Periods later).

- You are not entitled to receive any JobKeeper payments for the employee during the relevant JobMaker Period.

- You are not a major bank, government agency or entity in liquidation/bankruptcy.

- As at each claim date, your tax and BAS lodgements are up to date.

- You have employed at least one additional employee on or after 7 October 2020, and the additional employee is aged between 16 and 35 years of age on the date of commencing employment. Also, for a period of 28 consecutive days within the 84 days immediately before the commencement of employment with you, the additional employee received either:

- Parenting Payment;

- Youth Allowance; or

- Jobseeker Payment.

- Each additional employee must give you a completed JobMaker Hiring Credit Employee Notice, confirming eligibility.

- You had an increase in employee headcount, meaning the number of employees employed by you at the end of each JobMaker Period is higher than the number of employees in your baseline headcount. Your baseline headcount is your headcount on 30 September 2020 for the first year of JobMaker. All employees are included in the headcount, including full-time, part-time, casual, fixed-term and non-fixed-term employees. However, it excludes contractors.

- The additional employee’s average hours of work (including paid absences) across the JobMaker Period is equal to or greater than 20 per week.

- The additional employee is not a related party (e.g. a trustee, beneficiary, shareholder or director of the employing entity, or a relative of these parties).

- In the six months immediately before 6 October 2020, the additional employee was not engaged otherwise by you to perform substantially similar duties (e.g. as an independent contractor).

- Please note that eligibility for each JobMaker Period is assessed independently. This means you can become eligible at any point during the program.

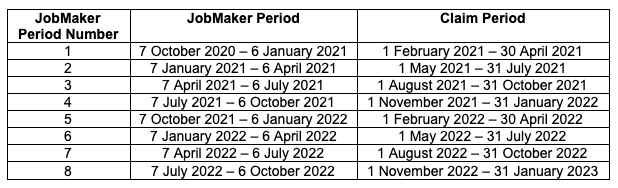

JobMaker Periods & Claim Periods

The program has eight quarterly JobMaker Periods, each with a corresponding Claim Period. The Claim Period is the time within which you must submit a form to the ATO through its online services (e.g. the Business Portal or the Tax Agent Portal) in order to receive the JobMaker for the relevant period.

The JobMaker Periods and related Claim Periods are as follows:

How do I register?

Before you can make a claim for JobMaker, you must first register your intent to claim with the ATO through the ATO’s online services (e.g. the Business Portal or the Tax Agent Portal). This registration must be completed before the end of your first applicable Claim Period. This means if you intend to claim JobMaker for the first JobMaker Period (7 October 2020 – 6 January 2021), you must register on or before 6 January 2021.

In the registration, you will need to declare:

- The total number of employees employed as at 30 September 2020 (the “baseline headcount”);

- The total payroll for the quarter up to 6 October 2020 (the “baseline payroll amount”).

How do I claim?

For each JobMaker Period, an online form needs to be lodged with the ATO before the end of the corresponding Claim Period.

As part of this form, the following information will need to be declared:

- The baseline payroll amount, if it changes from the amount declared as part of the initial registration;

- The total payroll amount for the relevant JobMaker Period;

- The total number of employees employed at the end of the JobMaker period.

The online form will rely upon information submitted to the ATO via Single Touch Payroll (STP), including the dates on which eligible employees commenced and/or ceased employment. It is therefore important that you ensure that your outstanding STP filings are lodged with the ATO at least 3 days before the end of each Claim Period, as it can take up to 3 days for these to be processed.

What happens after this?

Once the online form is submitted, the ATO will calculate and pay JobMaker to you. The amount of the credit depends on the number of additional employees throughout the relevant JobMaker Period compared to the baseline headcount, along with the ages of the additional employees ($200 per week for employees aged 16-29 year and $100 per week for employees aged 30-35). However, the credit will be capped at the value of the increase in the total payroll for the JobMaker Period over and above the baseline payroll amount. Please contact us if you would like to know how this cap may affect your claim.

What Do I Do Next?

The first step is to assess your eligibility to claim JobMaker in the first JobMaker Period.

The team at MGI South Queensland is available to assist you to assess your eligibility and navigate the complexity of the scheme. We are also able to assist you with lodgement of the registration form and quarterly claims.

If you need assistance understanding or actioning this new program, do not hesitate to contact us.