Subscribe for Our Latest Resources

"*" indicates required fields

We alerted you to recently passed legislation requiring all directors to have a director identification number (DIN). The DIN is a unique number that relates to the director (not the entity). Here’s how to apply for a Director ID.

Company directors are being urged by the Australian Tax Office (ATO) to apply for Director ID before November 30, 2022.

The Director ID program is designed to improve transparency, with the Australian Business Registry Services stating that “shareholders, employees, creditors, consumers, external administrators and regulators are entitled to know the names and certain details of the directors of a company”.

What is a Director ID?

The Director ID is a 15-digit director identification number that is unique to each individual director who has verified their identity with the Australian Business Registry Services (ABRS).

If the director changes companies or stops being a director, the unique identifier will remain with them forever.

If you are the director of a company, charity or not-for-profit organisation, a registered Australian body or registered foreign company under the Corporations Act 2001 or even an alternate director acting in a director’s capacity, you must apply for a new ID.

This also applies to directors of any Aboriginal and Torres Strait Islander corporation registered under the Corporations (Aboriginal and Torres Strait Islander) Act 2006.

All directors are required to apply for their own ID, however if you operate your business as a sole trader or partnership, you do not have to apply.

Unless directed otherwise by the registrar, if you are a director of more than one company, you only need to apply for one Director ID.

The date you need to apply for a new Director ID depends on when you were appointed as a director. From November 1, 2022, directors must have their new ID before their appointment.

Those appointed as a director on or before October 31, 2021, must apply by November 30, 2022.

For any appointments made after April 5, 2022, directors must apply for the new Director ID before they are officially appointed.

Current directors of Aboriginal and Torres Strait Islander corporations have an additional 12 months to apply for the new ID. Those appointed on or before October 31, 2022, must apply by November 30, 2023.

Criminal and Civil Penalties if you fail to apply

Company directors also face significant criminal and civil penalties if they fail to obtain a director ID, or fail to apply for one when directed to do so by the registrar. The maximum criminal penalty in these cases is $13,200 and the maximum civil penalty is $1.1 million.

Directors also face criminal penalties of up to $26,640 or one year imprisonment, and civil penalties of up to $1.1 million, if they apply for multiple Director IDs or misrepresent their Director ID.

The fastest way to apply for a Director ID by using the myGovID app to log in to ABRS online and verify your identity with information the ABRS has on record. You can check if your business is registered as a company with the Australian Securities and Investments Commission at ASIC Connect. Details of how to apply can be found here on the ABRS website.

If you can’t apply by the date you need to, you can complete an Application for an extension of time to apply for a director ID (NAT 75390, PDF 271KB).

Once you have received your DIN please forward this to our team to insert into our Corporate Secretarial software.

If you have any questions, please contact the team at MGI on

asic@mgisq.com.au

Queensland-based small to medium businesses can now apply for Round 9 of the Advance Queensland Ignite Ideas Government Grant Funding. Two tiers of funding are available:

Tier 1

Up to $100,000 (excluding GST) for projects of up to 12 months duration.

Tier 2

Greater than $100,000 and up to $200,000 (excluding GST) for projects of up to 24 months duration.

Successful Ignite recipients will have the opportunity to access additional business development support to accelerate their business.

Application process and timeframes:

Late applications will not be accepted.

For more information on the program and eligibility criteria, please see the website: https://advance.qld.gov.au/entrepreneurs-and-startups-industry-small-business/ignite-ideas-fund

When preparing an application, please ensure you satisfy the full eligibility criteria.

Please contact the team at MGI if you have any questions about Government grant funding.

Time is running out. Australian small businesses have until September 20, 2022 to register a domain name of .au, allowing the .com, .net or .org to be dropped from the internet address.

The Australian Small Business and Family Enterprise Ombudsman Bruce Billson has implored small businesses to take urgent action by 20 September deadline to safeguard their brand and identity on the internet or risk seeing impersonators, web-name ‘campers’ or cyber criminals take up domain names just like theirs.

The Ombudsman said the changes could see businesses lose their customer base or be at the mercy of cyber criminals impersonating them if they did not proactively sign up to the new system.

These shorter Australian domain names are currently reserved for businesses that already use the relevant com.au, net.au or org.au addresses until 20 September 2022. This change was announced by .au Domain Administration (auDA) which is the organisation responsible for internet domains in Australia.

Previously, it was only possible to licence lower level .au domain names, such as com.au, net.au, org.au.

If a business already had a domain name ending in .au, and registered it before 24 March 2022, the matching .au direct domain has been placed on a six-month priority hold – meaning that they have the first choice to register it. Any domain names not registered by 20 September 2022 will be available for the general population.

To be eligible for a .au direct name, you must have a verifiable Australian presence, which includes being a citizen or permanent resident, or being an organisation registered in Australia.

A domain name ending in the .au namespace (com.au, .net.au, .org.au, .edu.au etc.) indicates the business, organisation or individual using it has a connection to Australia.

There are also specific rules around whether businesses can register domains in the .au namespace.

You will be able to register new names via any participating .au accredited registrar in accordance with the .au Licensing Rules, as long as you are eligible to register the domain name.

Exact matches will be put on Priority Hold for the Priority Application Period to prevent them from being registered by others and to enable existing registrants the first opportunity to register (Priority Status) the exact match of their existing domain names.

In some cases, there also may be more than one applicant for the same .au direct domain name as there are different registrants that hold the same domain name licence in different namespaces. In these cases, the .au direct exact match will be allocated according to the Priority Allocation Process.

To find out more information, please visit the auDA website or contact the team at MGI.

While minimum wage increases are a boost for workers—increasing their gross income, buying power, standard of living, and disposable earnings – small business owners can struggle with the effects of raising minimum wage. Payroll is one of the most expensive things any business has to deal with, and a mandatory increase—in some cases, can put a major clamp on profit margins.

A minimum wage increase can improve the productivity of a business workforce, because higher wages reduce staff turnover. There is strong evidence that higher minimum wages lead to more stable and experienced workforces. In addition, firms can reap the benefits of employees who can focus more on work and are less distracted by the cognitive demands of poverty (for example thinking about how to get enough money to fix their car because it broke down)

If you’re a business owner, what can you do to survive?

Every successful business is proactive to reduce or remove inefficient costs. Consider making an investment up front that will, over time, drive down costs to a point at or below what you would lose in payroll increases.

Closely examine how you spend money. Do you have business expenses that you can reduce? Do you have flexibility in your business budget to rearrange money to payroll and away from something less critical to your business? Could your savings or investments be making more money for you in different ways.

Increasing prices is the most obvious option, and also the one many small business owners say will ultimately render any wage raises moot. If employers’ costs go up, they have to pass them on to the customers by raising prices, which means that, despite the increase in wages, life will be like it was before wages went up. This is called market equilibrium, and in this case, it would be achieved through inflation, or more dollars will buy the same amount of goods. So, even though pay-checks are bigger, buying power is the same in relation to new prices.

When business is good, you might consider looking to expand your business offerings to find new revenue stream or to improve cash flow. However, when times aren’t so good, cutting back offerings that don’t have as wide of a profit margin can be a prudent way of saving money. Reducing the number of products you offer can help you better manage inventory more efficiently. Sell only what’s making you the best return to increase your margins.

Most businesses are already running efficiently, so laying off workers often is not the solution. Businesses can reduce costs by carefully rostering and scheduling their workers to avoid overtime payments for excessive working that attract extra loadings. By carefully managing labour costs in this manner, businesses should be able to offset the increase in labour cost over inflation.

It’s a mistake to treat Australia’s current economic situation as one of austerity, where businesses need to tighten their belts to wait it out. In both good and bad times, a successful business owner always innovates. Innovation can range from reviewing a company’s operational processes to rolling out a new product or service. Those businesses who best seize the opportunities created by harsh conditions will come out the strongest in the end.

Because productivity is so important, it’s worth taking a deeper dive into the way work gets done within your business. Too many businesses still use manual processes that needlessly complicate their day-to-day operations. The hidden costs of paper-based and manual recordkeeping can really add up. Now’s the time to conduct an internal review. Ask yourself, what activities do your employees do, day after day, that could be automated? If those activities were automated, you might be pleasantly surprised at how much extra time they have to pursue more productive projects, adding better efficiencies and improved productivity to your business.

Talk to the business advisory team at MGI about our business coaching services and let us help you manage your business profitability and business growth. We can help you benchmark your business against others in the market, strategic planning planning, wealth management and also offer outsourced CFO services.

The Australian Taxation Office has recently simplified the way charities can submit an application for a refund of franking credits.

You can check your eligibility on the ATO website here.

As most charities are exempt from taxation they do not need to lodge an income tax return. Many charities invest excess funds to build a capital base to sustain their charitable operations into the future. If charities received fully franked dividends, then they are able to apply for a franking credits refund.

In previous years, you had to call the ATO to organise a franking credit refund application form.

The ATO has now released the application form online with instructions on how to fill out the form.

The Application Form can be accessed here.

If you would like more information about the application for franking credits refunds or require assistance with the refund application form, contact the team at MGI.

The Queensland Government has launched a business growth fund grant for small-medium size businesses who can accelerate growth, drive Queensland’s economy and employ more Queenslander’s.

Expressions of Interest (EOI) close at 5.00pm June 30, 2022

You may be eligible for a single up-front payment of up to $50,000 (excluding GST), and not less than $25,000 (excluding GST).

Successful applicants must co-contribute at least 25% of project costs.

The program provides funding for businesses to buy specialised equipment, enabling them to unlock growth potential, increase production, expand their workforce, and maximise economic returns to move them to the next stage of growth.

For more information on eligibility criteria and how to apply, can be found on the Queensland Government business website.

Please contact the team at MGI if you have any questions or require further information.

We alerted you to recently passed legislation requiring all directors to have a director identification number (DIN). The DIN is a unique number that relates to the director (not the entity).

This is a new requirement for ALL Directors & Alternate Directors of a company.

Details of how to apply can be found here on the ABRS website.

New Directors who have recently been appointed must apply for their own Director ID immediately as the 28 day grace period has now ended.

If you want to become a director you will need a director ID. This includes all overseas Directors.

All new Directors (those who have never previously been appointed as a Director) must apply for their Director ID number prior to appointment.

Please Note: There are no exemptions.

Any individuals who became a Director or Alternate Director prior to 31/10/2021 have until 30/11/2022 to obtain their DIN.

Please be aware that the ABRS may impose large penalties on any directors who have not applied for their DIN within the required timeframe.

If you can’t apply by the date you need to, you can complete an Application for an extension of time to apply for a director ID (NAT 75390, PDF 271KB).

Once you have received your DIN please forward this to our team to insert into our Corporate Secretarial software.

If you have any questions please contact Kym Steenberg at ksteenberg@mgisq.com.au

Find out how to apply for a Director ID.

The NSW Government has recently announced their latest round of COVID Business Support packages targeting business, workers and the performing arts with applications open from mid-February. Summarised below are the key items and details from the announcement:

Eligible business will receive 20% of weekly payroll with a minimum as a lump sum for the month of February, with a minimum payment of $750 per week and a maximum payment of $5,000 per week. Non-employing businesses won’t miss out either receiving $500 per week in the form of a $2,000 lump sum payment.

Eligibility for the grant is summarised as per below with applications open mid February:

The existing RAT rebate has been increased to $3000 with employing small businesses being able to use the rebate to cover half the cost of the Rapid Antigen Tests (RATs). Note, these funds can be used to offset other government fees and charges such as licences, event fees, council rates and road tolls. If you are already registered, no need to worry as you will receive an automatic top-up to $3000.

The existing protections for small retail and commercial tenants will be extended under the Retail and Other Commercial Leases (COVID-19) Regulation 2021 until 13 March 2022. To assist eligible landlords, grants of $3,000 (GST inclusive) per property are available for each month that they provided rental relief waivers to tenants. Please be aware that rent relief waived must comprise at least half of the amount granted to the landlord.

Landlords who have claimed the 2021 land tax relief are also included in the Commercial Landlord Hardship Grant program. Note, landlords under the above regulation are unable to evict or lockout their tenants until they have attempted mediation or renegotiation of rent if the tenants are eligible.

The NSW Government is looking to provide additional financial support for the performing arts sector. To gain access to government supported funding applicants must be one of the following:

The NSW Government has also provided clarification over what defines each applicant:

Eligible Venue: List created and maintained by Create NSW from their own assessment

Eligible Performance: Requires evidence of the performance through marketing, and ticket sales must be managed through a ticketing system listed by Create NSW.

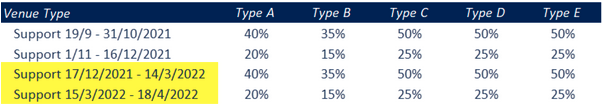

Once eligibility is determined funding will be provided between 19 September 2021 and 20 April 2022. The total funding is calculated as per below:

Funding = Average Ticket Price x Number of Tickets on Sale x Agreed Percentage.

The agreed percentage is determined by the below table, and with different venues receiving different funding amounts.

Note, NSW Government will cap funding at 10,000 tickets (e.g. no funding for the 10,001 tickets).

If you’d like further support to explore the NSW COVID business support packages on offer, don’t hesitate to contact a member of the MGI SQ team.

Monochrome is a client of MGI South Queensland. This interview took place on Wednesday 15/12/21

Karen Ng, from our Brisbane office, spent some time talking with Craig Hobart, Head of Distribution to find out more about the world of investing in Cryptocurrency and what they are accomplishing in Monochrome.

Disclaimer: MGI South Qld does not provide financial advice to clients and this article is not intended to provide professional advice in any shape or form. MGI have produced this purely to highlight the interesting ventures of our clients and to give some interesting information on relevant topics in the marketplace. We recommend that readers of this article obtain their own financial advice before considering any of the investments discussed in this article.

Karen: Craig, thank you for your time and spending time talking to us today. Tell us a bit about yourself and tell us a bit about Monochrome.

Craig: I’ve been in the funds management industry for 25 years, predominantly in the intrinsic value, investing space around Australian equities. More recently, I was on the executive of a large industry fund called REST Industry Super. What attracted me to this business was a recognition that Bitcoin and digital currency, is a nascent asset class, and newish asset class. There is a lot of demand for understanding and inquiry around what is going on in this space. It’s been predominantly consumer driven and, importantly, that has created some problems. For example, digital exchanges are not regulated. So, if you buy through an exchange, you don’t actually own the digital currency, the exchange does and they make a promise to you that if they collapse, you lose your wealth. Obviously, a lot of the ramps in and out of these assets is fraught with fraud scams, I mentioned, the exchanges are also unregulated themselves. So, I saw there was a need and I identified with Monochrome’s vision that we need a solution that provides a safe pathway for investors to get exposure to digital assets.

Equally as important, I saw there’s obviously so much misinformation out there. This is one of those things, it’s like Dr. Google, yes, if you Google digital assets, you will go down a bunch of paths that are manipulative. There’s an agenda sitting behind the content that’s provided. Therefore, there is a very important role that Monochrome could play in providing balanced, independent, objective research that would allow not only investors but importantly, the advice community to explore what is occurring in the asset class.

Karen: What does that look like?

Craig: We’ve produced CPD content. Content that advisors can put on their training register as their continuing education requirements. We’ve put six modules on our website as well, which provide a foundation for advisors to get started in this space and respond to their client’s inquiry. For context, we did a survey and 77% of advisors have taken inquiries from their customers. And 89% of them have said that they’re ill equipped to respond. And that’s for a range of reasons. It’s regulatory. Their licences have not allowed them to advise not until the 29th of October. And there’s been no products that are issued. We could see that what we call “suits” were coming into the asset class, in other words, institutional investors, participants, therefore Monochrome has arrived at a time which provides a ramp for investors whether they be wholesale and ultimately retail. When we issue a PDS, it will be a pathway to get exposure safely. Also, provide an appropriate platform for institutional investors, like industry funds and sovereign funds to get exposure, and we use all of our knowledge around digital assets to provide that safe custody experience.

Karen: How would you describe Monochrome’s vision?

Craig: Okay, so our vision is to provide safe access to digital assets and to educate the market. Our foundation product is a Bitcoin fund and all that we do is buy the Bitcoin at the spot price at the end of the month, and put it in what we call cold storage, which means it can’t be hacked or got to it’s a bit like Fort Knox, I guess, like gold and continue to educate the market. It’s a very simple product, we’re not trying to generate outsized returns or do anything tricky. We’re not trying to pick the time of the day, that week that month to buy bitcoin, we just buy it at the market price at the end of the month, and invest it, put it in cold storage, and it’s a buy and hold Strategic Fund, it doesn’t have any intention of doing anything other than provide people that safe access to the asset class. That’s our foundation product, we will do other things in time. Bitcoin is the dominant digital asset by market cap in the world, and it’s also the foundation one, meaning that the protocol of Bitcoin won’t break. The technology is robust, it’s very liquid, meaning like that’s a deep liquid market, it’s over a trillion dollars. There are plenty of liquidity providers, and all the things that ASIC requires of this asset class to be suitable for an ETF, for example, is things like institutionally supported strong service providers, a spot market for accurate pricing, a regulated futures market for the asset, all of those characteristics and things exist with Bitcoin and initially, the only other asset out of the 10,000 out there. The only other one that meets that hurdle is Ethereum. So those two are what ASIC have given permission to proceed forward with.

Karen: You have mentioned that education was probably the biggest barrier for financial advisors to look at this asset class. There is still the opinion that cryptocurrency and Bitcoin, is a “Ponzi” scheme. How do you see that changing? Will it be at the point of when the ASIC and ASX sort out regulation? You are right in the thick of it all and talking to many financial advisors? Have you seen that change?

Craig: Well, there’s a few things inside all of that I mentioned, my background was Intrinsic value investing, so I’ve had to go on a journey as well. The first thing you have to recognise with Bitcoin, is that most other assets, in some way or another, they produce an income stream, whether it be dividends, profits, rental yields, bond yields, coupons and everything in the intrinsic world is linked to interest rates in one way or another. So, when you value a company, you do a discounted cash flow, and you have to put a risk-free rate in and you have to put an equity risk premium in and then you have a discount rate. The first thing to understand is that this (Bitcoin and other digital assets) doesn’t operate on that way of value, which for a lot of advisors is that’s it for them, “I only invest in things that I can intrinsically value”. That’s the Warren Buffett’s of the world, the Hamish Douglass’s of the world, they all operate in that realm, which is completely acceptable and understandable. What is interesting about Bitcoin in particular, is it’s not nominally valued, because it doesn’t produce an income stream and therefore, by inference, it’s not caught up in an event that occurred for the last 20 to 30 years as interest rates have gone down.

All of your readership has seen the value of their homes go up and money has become cheap. We’ve seen equity markets go up & up and we were reaching the end of the dance. We can’t ring any more out of the economy on nominal interest rates. Institutional investors are really looking for some insurance against a market correction, and a realisation that this dance can’t go on any further or for much longer. It’s quite nerve racking, in a way. We’ve seen some industry funds pull risk earlier, meaning like they said that this is all too expensive and have gone conservative being left behind. And they’ve been punished for that. Even though they might be right in the long term.

Bitcoin, for the institutional market, is also seen as a form of insurance because it’s not nominally valued, it’s a store of value and it can sit there when other things collapse. Like gold is sometimes seen as and is used for that purpose as well.

Now, Bitcoin still needs to prove itself, but that’s some of the thinking that’s occurring in that space. Our role in Bitcoin is not for everyone. I mean, it’s volatile. You need to have asbestos gloves on when you handle it. And you need to understand what it is. A lot of education is around the volatility, about the correlation with other assets and the limiting of exposure to percentage of your portfolio like we looked at the United States advice into experience which is ahead of Australia in this particular asset class in terms of understanding, and it’s one to 5%, is kind of where they actually say to clients, and it’s appropriate, how much are you willing to lose? What percentage of your wealth and of course, that then gives everyone a sense of their risk tolerance, and then when you invest it, you monitor it. If it doubles in value, and you’ve got a 1% allocation that goes to 2%. Well, you profit and then reinvest that in your diversified portfolio then need to put some disciplines around dealing with volatility. That is a strategy in itself, but also an awareness because it’s volatile, expect it to be volatile and not be put off by it.

When we turn to value itself, with Bitcoin, there are a number of models out there and people have different ways they look at things like network effects, like how infused is it in its brand value, like Bitcoin itself.

It’s very interesting times. If you take a very simple approach to Bitcoin, which is an economic 101, supply and demand, that determines price, what someone is willing to pay for something, not what it cost to produce, but what they’re willing to pay for it. That’s an interesting way of looking at what is occurring.

We know there isn’t a finite supply of Bitcoin to be mined, it’s 21 million coins, and we’re hovering around the 19 million mark. And every 10 minutes, six and a quarter coins are produced, and there’s a harvest every four years.

That means we are at the end of the production cycle. 99% of all Bitcoin will be mined by 2040. And that last 1% will take another 100 years. Inside of that is the demand equation. Interestingly, a couple of things, this is one of the reasons I got involved in the venture was there are a lot of believers in Bitcoin, and they’re very disciplined around their belief.

And they invest the percentage of their income every month, in continuing to add to their wealth inside the world of Bitcoin, the demand function for that exceeds the supply function, just that alone. If you think of all the coins that are going to be manufactured through this mining process in the next 12 months, over 100% of that production has already been requested through people that are already in Bitcoin, they want to continue to add to this, then we add to it the “suits” that I referred to coming into the sector, the institutional investor, you can just see that the demand exceeds the supply. That has to give us some growth. There may or may not be but certainly the protocol of Bitcoin’s not going to break, like that’s approved 13 years, it’s the first blockchain framework that’s beautiful and it’s eloquent in the way that it was manufactured and it’s not going to break. Bitcoin itself is robust, what you paid for it. That’s the market and we think in life, we don’t realise how much sentiment drives decisions, for example, residential real estate property. We do it all the time. Everyone’s very confident in residential and what we do is look at competitive prices. What did the house on the left sell for and how much did the one on the right sell for?

In the Bitcoin world, what did the coin on the left sell for and how about the one on the right? I know it sounds overly simplistic, but in reality, that’s what’s occurring and we see it in things like how much you are willing to pay for a pair of shoes, or for fine art, or, for a motor car, we’re seeing prices of vintage cars going up, and it’s what someone’s willing to pay for it. They’re all sentimental, we live with a sentiment market. In fact, if we look at traditional equities, you know, Tesla’s on a P E of 350 times, four months ago, it was on 1000 times. An intrinsic value investor wouldn’t be attracted to a stock like that. Even in the real, intrinsic investing world, there are many examples of sentiment being the determinant of the price that people are willing to pay.

Karen: Craig, it’s been a great conversation. Last question, what is one piece of advice for the consumer, who’s looking at possibly entering the asset class of investing in cryptocurrency and Bitcoin especially and then the other one being advice for business owners.

Craig: Yeah, I think, for consumers, do your homework and read extensively. Be careful of what you’re reading, you certainly can come to our website, the comfort of knowing that there’s no bias or sales pitch or anything other than just informing and educating. Like anything in life, before you invest, you should invest the time and understand what it is. Certainly, what we’ve seen with consumers is they just get on a rush from things going up, we’ve got our own fear of missing out. Yes, without having done the homework, we sadly say 90% of all digital ventures fail, no different to what happens in equity markets, or pre-equity markets and there’s a high failure rate. So the first thing is just to be very aware of your interest, and then channel that into knowledge gathering before investing and then be very wary about your pathway or ramp into an asset, particularly around digital assets. We have had plenty of experiences where people think they’re investing in an exchange, and it’s not, it’s a front, that’s a fraud. It’s an area where you need to be particularly careful.

For consumers, I think if they want to explore it, they should do their homework and verify and verify and verify. And make sure that they don’t get caught – the schemes and scams are very sophisticated now. So, they need to be extremely careful before they invest in it. There’s a lot to get over to be able to actually invest. Again, that’s why we came into existence is to basically take all of that concern. So, in terms of the pathways into the asset of the away, so there’s a claim, trusted by through trust accounting in a custodian.

The other thing, of course, for consumers is that when PDS are issued, take the time to read the target market determination, the TMD, which is new legislation. To really understand the PDS before you invest in it. I will be quite clear and it’s important that you read it. A lot of people don’t. And when things don’t turn out the way they want them, they want other people to take accountability for their lack of preparation for the investment. I think consumers need to be very patient about the documents that are prepared, particularly a PDF.

The target market determination, basically, on a page will tell the investor what to expect, are you this type of investor? What is the volatility? How long should I be investing? And, you know, that’s an important step that every investor should put themselves through before they invest.

In terms of business owners

There’s a number of things in this. We’re seeing innovation occurring with digital currency, which opens up new markets for businesses. You see companies like Square and Tesla, for example, have Bitcoin on their balance sheet and Twitter. There are a number of companies that are starting to invest in the primaries and they’re actually investing in Bitcoin, because they actually need a treasury function around the asset itself, because they are offering an alternative form of payment, or a service for their customers. We’re starting to see that.

There’s a range of participants that would love or like the opportunity to transact with a company, not using a fake currency, but using Bitcoin for example, you would have seen in the press recently a tropical island up in North Queensland, being offered for sale, settlement with Bitcoin?

Karen: Yes. I have heard of that

Craig: It’s emerged from a business strategy perspective. It’s just a new way of presenting your business to the market and taking another form of payment. If that develops, then that becomes a treasury and that’s where your accountant gets involved. The question becomes should you have a sleeve of your holdings in this other currency because that’s what you’re transacting in and then going back to the fundamental discussion around how your wealth should be invested in the price of Bitcoin and a portfolio can equally apply to a balance sheet. Remember I’m not giving personal advice here. I haven’t met the person on the other end of the camera. So, all those disclaimers need to be said, of course.

Karen: Yes of course. We are NOT a financial advice firm, and we are confirming that this is just an interview with one of our clients, a series we will hopefully continue in our newsletters. Craig, thank you for the tips and the really great insight to what’s happening in the world of Bitcoin and what’s happening in Monochrome as well. I’m very excited to hear about the journey so far. I certainly think that Monochrome has got a lot of great things ahead of them. So, thank you it really will be a case of “Watch this Space”

Craig: Yeah, we just have to be patient. The market takes time too, to get our head around it. So, you know, when you’re starting a business, it’s awareness, consideration and then there’s a purchasing decision. There will be competitors that will come in behind us and there will be flattery. In other words, they’ll be plagiarising our business model and our ideas. But, you know, we’re a specialist business that offers something special. We’re looking forward to how the next couple of years plays out.

Karen: Thanks Robert, for giving your time today to discuss this topic.

Data recently released by the Australian Tax Office (ATO) confirm that Australians have continued their love affair with self managed superannuation funds (SMSF’s).

The ATO publishes quarterly information about SMSF’s. Here’s a summary:

At 30th September 2021, there were nearly 600,000 (598,452) SMSF’s with just over 1.1m members (1,123,949), averaging 1.87 members per fund. With 53% of male members and 47% of female members, most SMSF’s appear to be your typical “mum and dad” super fund. Just on 70% of SMSF’s are two member funds, around 23% are one member funds, with the balance being three and four member funds.

Based on the most recent data available (2020 year), the average value of a SMSF is around $1.3m, with an average value per member of around $695k. This compares favourably with the average super fund balance of all Australians, which for those aged between 40 and 55, is between $121k and $214k for men and between $92k and $157k for women. (1)

The ATO data indicates that SMSF’s hold more than $860 billion in wealth, with around $29 billion in borrowings and a further $6.7 billion in other liabilities resulting in total net SMSF assets of around $825 billion. So, where is all this money invested?

Well, around $149 billion (or around 18%) is invested in cash and term deposits. A further $238 billion (or around 29%) is invested in listed shares and $53 billion (6%) in listed trusts. A further $134 billion is invested in property, with most of that (around $88 billion) invested in non-residential property.

Interestingly, the proportion of SMSF funds invested in cash and term deposits is highest amongst smaller balance SMSF’s, perhaps reflecting a more conservative approach given the recent volatility in share markets.

Around $63 billion of SMSF wealth was invested in limited recourse borrowing arrangements (LRBA) – basically, assets purchased by SMSF’s using allowable debt. This could be either shares or property. The appetite for LRBA’s appears to be highest in SMSF’s with between $200k and $1m in assets, with an average of around 15% of fund assets comprising LRBA’s.

SMSF trustees have also embraced crypto-currency, with around $230m held in crypto. This has grown steadily since the ATO commenced to measure investments in crypto.

There appears to have also been an increasing appetite for international shares, which now stands at around $12.5 billion.

Interestingly, around half a billion dollars ($509m) is invested in collectables and personal use assets.

In terms of member ages, there is a relatively even distribution between members aged 35 to 84, but relatively small representation from members aged under 35, perhaps indicating the lack of superannuation savings from this age group to be able to justify the establishment of a SMSF.

Interestingly, the 2021 financial year saw a near 20% surge in new SMSF’s established with 25,760 new funds established. However, the number of wind-ups of SMSF’s in 2021 halved from the levels of the previous two years, resulting in a significant increase in the number of net establishments. So it appears that Australian’s love affair with SMSF’s may have longer to run yet.

(ASFA figures as at July 2019).

If you need the support of a specialist SMSF accountant, the team at MGI are here to help.

"*" indicates required fields

MGI refers to one or more of the independent member firms of the MGI international alliance of independent auditing, accounting and consulting firms. Each MGI firm in Australasia is a separate legal entity and has no liability for another Australasian or international member’s acts or omissions. MGI is a brand name for the MGI Australasian network and for each of the MGI member firms worldwide. Liability limited by a scheme approved under Professional Standards Legislation.

Enter your details to access the guide

Select your desired option below to share a direct link to this page.

Your friends or family will thank you later.