Subscribe for Our Latest Resources

"*" indicates required fields

As Australia prepares for Payday Super, most employers are focused on one question: “Will our payroll software be ready?” Payday Super is not just a technical change. It will change payroll processes. It’s also a people change, a systems change and a governance change. Behind the scenes, employers will need to redesign workflows, elevate data quality, streamline approvals, train staff and tighten controls to avoid compliance risk.

If you are still getting up to speed on what Payday Super is and when it starts, read our guide What Is Payday Super And What Do Employers Need To Think About Now? first, then come back to this article for a deeper look at the operational changes required.

We will also be running a webinar: Payday Super Changes: What Employers Need to Know Before July 2026 on Thursday 29 January at 1.00pm (AEST). Register now to secure your spot.

Here is what is really involved in getting your processes, systems and people ready.

Yes, payroll vendors are updating their platforms to calculate and transmit super in real time. That is important, but it is only one element of Payday Super readiness.

Even the best configured system will fail if:

Software is an enabler, not the whole solution. The real work sits in the processes wrapped around the system and the payroll compliance framework you build around it.

Under quarterly super, payroll teams had a buffer. If an employee’s:

were incorrect, there was usually time to fix it before the payment deadline.

With Payday Super, that buffer disappears.

Common data risks include:

Payday Super exposes errors much faster, so data cleansing and stronger data controls must happen now, not after the regime starts. Good data integrity underpins both system performance and payroll compliance.

Payroll teams used to operate on fortnightly or monthly cycles with quarterly super deadlines in mind. Now, super must be paid at the same time as wages.

This requires redesigning:

✔ Timesheet cut-offs – late approvals will now cause late super.

✔ Manager approvals – super cannot wait while managers hunt for roster corrections.

✔ Exception handling – adjustments must be completed within the same pay cycle.

✔ Payroll-to-Super handover – data must flow instantly, not days after payroll is finished

✔ Treasury coordination – Cash must be ready every pay run, not once per quarter. Read our detailed blog: “Cash Flow Planning For Payday Super” for more insights.

Most organisations will need to re-map their entire payroll workflow, from roster to bank to clearing house to general ledger, to ensure it can support the timing rules of Payday Super.

Not all clearing houses are built for high frequency payments. Under Payday Super, employers must consider:

If your clearing house cannot process payments within your pay cycle, you risk automatic SGC exposure even if your payroll is on time.

Switching clearing houses, or upgrading to a more integrated solution, may be necessary and should be done well before Payday Super begins. This decision should sit alongside broader systems and governance planning, not as a last minute fix.

Payday Super increases regulatory scrutiny. The ATO will have more timely data and employer errors will surface faster.

Employers must strengthen:

Strong governance is now a core compliance obligation and should sit alongside your broader payroll compliance work.

The best systems and processes will fail without people who understand and follow them.

Payroll teams need training on:

HR teams need training on:

Managers need training on:

Employees need communication on:

Payday Super is not just an operational change. It is a whole-of-business change that requires clear, consistent communication across multiple teams.

Payday Super will test the maturity of payroll processes across Australia. Software alone will not make an employer compliant.

Success requires:

These process, systems and people changes sit alongside a review of payroll frequency, cash flow planning and payroll compliance as the core pillars of Payday Super readiness.

If you want support in redesigning your payroll to super process end to end for Payday Super, our team can help you:

Talk to us about a Payday Super process and systems review, or start with our pillar guide What Is Payday Super And What Do Employers Need To Think About Now? to see how this operational work fits into the broader change.

Remember to register for our webinar: Payday Super Changes: What Employers Need to Know Before July 2026 on Thursday 29 January at 1.00pm (AEST).

With the introduction of Payday Super, many employers are reassessing whether their current pay cycle – weekly, fortnightly or monthly – still serves them operationally and financially. One question is emerging more frequently: Should we switch to monthly payroll?

Monthly payroll can offer meaningful advantages under the new super regime, but it also has constraints and risks that employers need to consider carefully.

If you are still getting up to speed on what Payday Super is and when it starts, read our guide What Is Payday Super And What Do Employers Need To Think About Now? first, then come back to this article for a deeper look at payroll frequency decisions

We recently ran a webinar covering the key changes and the playback is available: Payday Super Changes: What Employers Need to Know Before July 2026.

This guide breaks down the key factors to help you decide whether monthly payroll is right for your business under Payday Super.

✔ Reduced Payroll Administration

Monthly payroll means fewer pay runs per year:

This reduces:

Under Payday Super, reducing super payment frequency from 26–52 payments down to 12 can significantly cut administrative and payroll compliance pressure.

✔ Smoother Cashflow Management

With fewer pay runs:

For businesses with tight or volatile cash cycles, monthly payroll can make cash flow planning easier, provided processes are well controlled.

For a detailed look at how Payday Super affects cash flow, see our guide: Cash Flow Planning For Payday Super: How To Avoid Surprises.

✔ Better Alignment With Monthly Revenue Cycles

Many businesses bill monthly. Aligning payroll with billing cycles can create:

For organisations with strong monthly revenue patterns, monthly payroll can align outflows and inflows more neatly.

✔ Easier Governance Under Payday Super

Because super must now be paid on payday, monthly payroll means:

Monthly payroll is inherently lower risk under Payday Super, provided your payroll systems and controls are set up correctly. Read our blog: Payday Super And Payroll Processes: The Changes You Need To Plan For

Despite the advantages, monthly payroll does not suit every business.

✘ Employee Cashflow Pressures

Employees used to weekly or fortnightly pay may struggle with:

This can impact morale, increase HR queries and make the change unpopular if it is not supported and communicated well.

✘ Award and EBA Restrictions

Some awards and enterprise agreements require:

A move to monthly payment frequency may not be legally permitted, depending on the industrial instrument. Payroll frequency cannot be changed purely for convenience if it conflicts with award, EBA or contract obligations.

✘ Higher Risk if Errors Occur

Because pay cycles are longer under monthly payroll:

Payroll teams need strong controls to avoid large monthly errors. When combined with Payday Super, a single incorrect payroll can mean a significant super underpayment that is immediately visible to the ATO.

✘ Operational Timing Constraints

If timesheets, rostering, or labour costs change rapidly (for example, in hospitality, healthcare or retail), a monthly cycle may be operationally cumbersome.

Shorter pay cycles can make it easier to:

In these environments, weekly or fortnightly payroll may still be more practical despite the extra administration.

Before making any decisions about monthly payroll, confirm:

Where interpretations are unclear, legal or HR advice may be required. Payroll frequency sits at the intersection of compliance, operational reality and employee expectations, so it is important to get this step right.

If shifting to monthly payroll is permitted and appropriate, communication is crucial. Effective communication should include:

✔ Advance notice – provide at least one or two pay cycles notice.

✔ Budgeting support – tools, webinars or simple financial guidance can prevent stress.

✔ Clarity on cut-off dates – timesheets and approvals may need new deadlines.

✔ Transparent explanations – employees should understand why the business is moving (for example, compliance, simplicity, efficiency).

✔ Channels for questions – HR inboxes, Q&A sessions and one-on-one support may be needed initially.

Handled well, a move to monthly payroll can be accepted and even welcomed. Managed poorly, it can damage trust and engagement.

Under Payday Super, monthly payroll can materially reduce:

Because super is paid on payday, fewer paydays mean fewer possible points of failure. For many employers, monthly payroll is one of the most practical structural adjustments to accommodate Payday Super, alongside improvements to payroll systems, processes and governance.

Case Study 1: Professional Services Firm (40 staff)

Result: Monthly payroll improved cash flow alignment and reduced payroll processing time by around 60 per cent. Payday Super obligations became easier to manage with fewer super payment dates.

Case Study 2: Tech Startup (20 staff)

Result: The Payday Super transition had little operational impact. The existing monthly payroll structure proved ideal for continuous super requirements.

Case Study 3: Aged Care Provider (120 staff)

Result: Monthly payroll was not viable due to award rules, operational realities and workforce expectations. The provider focused instead on strengthening payroll compliance, cash flow planning and payroll process and systems within a weekly/fortnightly framework.

There is no one size fits all answer. Whether you should move to monthly payroll under Payday Super depends on:

Under Payday Super, monthly payroll offers significant benefits – but only if it aligns with your legal, operational and cultural environment. In some businesses, a strengthened weekly or fortnightly process will be a better answer than a frequency change.

If you are unsure whether monthly payroll is right for your organisation, we can help you:

Book a meeting now about whether a change in pay frequency could streamline your operations under Payday Super, or start with our pillar guide: What Is Payday Super And What Do Employers Need To Think About Now? and our articles on cash flow planning and payroll compliance to see the bigger picture.

Remember to register for our webinar: Payday Super Changes: What Employers Need to Know Before July 2026 on Thursday 29 January at 1.00pm (AEST).

With Payday Super requiring employers to pay superannuation at the same time as wages, payroll compliance is about to come under much sharper scrutiny. The ATO will receive more frequent and more accurate data through Single Touch Payroll (STP), meaning errors that previously went unnoticed until quarter-end will now surface much sooner.

We recently ran a webinar covering the key changes and the playback is available: Payday Super Changes: What Employers Need to Know Before July 2026.

If you are still getting up to speed on what Payday Super is and when it starts, read our guide: “What Is Payday Super And What Do Employers Need To Think About Now?” first, then come back to this article for a deeper dive into payroll compliance risks.

For employers, this means your payroll compliance processes, classifications and controls need to be more robust than ever.

Here are the top 10 compliance risks no employer can afford to ignore.

Misclassifying workers (for example, casuals vs part timers, contractors vs employees) can cause:

Payday Super shortens the correction window significantly, so errors must be fixed immediately. Getting employee classifications right is a core part of payroll compliance under the new regime.

Some allowances and payments attract super; others do not. Common problem areas include:

With super due on payday, any misinterpretation of superable payments will lead to instant underpayments and immediate payroll compliance issues, rather than something you can tidy up at quarter-end.

The ATO’s definition of an “employee for SG purposes” is broad. Contractors may attract super even if:

This is one of the most common sources of SG non compliance and will be even riskier under Payday Super. Reviewing contractor arrangements now is essential to keep payroll compliance intact once the new rules begin.

Under Payday Super:

The reduced time window means payroll teams cannot rely on quarter-end corrections anymore. Timing becomes a key element of payroll compliance, and late payments will also create knock on cash flow pressure.

We explore the impact of Payday Super on cash flow in our blog: “Cash Flow Planning for Payday Super: How to Avoid Surprises”.

Manual handling of:

…will create major compliance risks.

Every payroll cycle must be accurate because you cannot fix super after the fact without triggering late payment penalties and SGC.

Automating calculations and building clear review checkpoints into each pay run is fundamental to strong payroll compliance under Payday Super.

Many payroll systems will require updates for:

Incorrect configuration will automatically flow into super errors, even if staff are doing everything else correctly. Take a read of our blog about Payday Super And Payroll Processes: The Changes You Need To Plan For.

Before Payday Super starts, employers should work with their software providers or advisers to validate that system settings are correct and tested.

Incorrect pay codes are one of the most frequent causes of super mismatches and payroll compliance failures.

Before Payday Super starts, employers should review:

Fixing pay codes and allowance logic payroll processes now prevents repeated SG underpayments once Payday Super is live.

Missed or late super often comes from poor data capture and weak processes when people join or leave the business, such as:

Under Payday Super, late onboarding or overlooked changes can mean instant late super and payroll compliance breaches. Strengthening onboarding and offboarding checklists, and making sure payroll receives complete, timely information, is critical.

Labour hire and contractor structures often contain hidden SG risks. Common red flags include:

ATO scrutiny in this area is already high and Payday Super will amplify it, as patterns of underpayment become easier to spot in near real time. A review of contractor and labour hire arrangements should be part of any Payday Super payroll compliance project.

Quarterly super reconciliations will no longer be enough. Employers must introduce:

These controls are now essential to avoid SGC liabilities and to demonstrate sound payroll compliance if the ATO reviews your business.

For many organisations, this will also involve tightening broader processes, systems and governance around payroll.

Payday Super changes the payroll compliance landscape. Errors that may have gone unnoticed for months will now be detected quickly through STP and super payment data.

Employers who strengthen payroll governance now will:

Robust payroll compliance is no longer a nice to have, it is essential to operating safely under the new rules.

If you would like to understand your payroll compliance risks before Payday Super shines a spotlight on them, we can help you:

Remember to register for our webinar: Payday Super Changes: What Employers Need to Know Before July 2026 on Thursday 29 January at 1.00pm (AEST).

Book a Payroll Health Check and we will identify compliance risks before Payday Super catches them.

For a broader view of the change, start with our pillar guide: “What Is Payday Super And What Do Employers Need To Think About Now?” and explore our related articles on cash flow, payroll frequency and payroll processes and system changes.

With the introduction of Payday Super, employers will soon need to pay employees’ superannuation at the same time as their wages – rather than quarterly. While this change improves transparency and protects employees, it also creates a new set of challenges for business cash flow planning and management.

For many organisations, the shift from four super payments a year to ongoing, frequent outflows requires a complete rethink of how cash is forecast, managed and allocated. Proactive cash flow planning for Payday Super will be essential to avoid nasty surprises.

If you are still getting up to speed on what Payday Super is and when it starts, read our guide What Is Payday Super And What Do Employers Need To Think About Now? first, then come back to this article for a deeper dive into the cash flow impact.

We recently ran a webinar covering the key changes and the playback is available: Payday Super Changes: What Employers Need to Know Before July 2026.

This guide explains how Payday Super affects cash flow, the key risks to watch and practical steps you can take now to protect your working capital.

Here’s how to get ahead of the change.

Under the current system, employers often treat superannuation as a large but infrequent payment – paid up to 28 days after the end of each quarter. Many employers accrue super amounts in their accounts and pay them in a single lump sum after quarter end. In effect, super has acted as a short term source of funding inside the business.

Payday Super changes this dramatically:

For businesses with tight or seasonal cashflow, this shift reduces flexibility and increases the need for accurate cash flow planning and forecasting. Without proper planning, you may find yourself short of cash at critical times, such as BAS lodgements, rent, loan repayments or payroll.

The foundation of effective cash flow planning for Payday Super is understanding what super outflows will look like under your current payroll schedule. Here are simplified illustrations.

Weekly Payroll Example

Annual impact:

Fortnightly Payroll Example

Annual impact:

Monthly Payroll Example

Annual impact:

The total super paid over the year is unchanged, but cash leaves the business earlier and more frequently than under quarterly payments, which needs to be factored into cash flow planning.

To avoid sudden strain on liquidity, businesses should consider implementing cash flow smoothing methods such as:

✔ Establishing a dedicated superannuation holding account

Move SG amounts into this account each pay run. This stabilises cash flow and avoids the risk of underfunding when payments fall due.

✔ Increasing payroll frequency reserves

Maintain a reserve fund that covers one to two full pay cycles, including wages and super.

✔ Aligning invoice cycles with payroll cycles

Where possible, bring forward billing or shorten payment terms so cash inflows better match your payroll schedule.

✔ Introducing rolling cashflow forecasts

Shift from quarterly or high-level monthly forecasting to weekly cash flow projections so you can see pressure points early and act in time.

✔ Automating payroll and super payments

Automation reduces delays, errors, and compliance risk, keeping cashflow predictable.

Read our blog on: Payroll Compliance Under Payday Super: 10 Things Employers Can’t Ignore for a more in-depth look at the key ATO obligations, common risk areas and how to tighten your payroll controls.

Some employers may find that their current pay cycle becomes inefficient under Payday Super. You might consider a change if:

Before changing pay cycles, consider:

Read our in-depth blog: Payday Super and Payroll Frequency: Should You Move To Monthly Pay? for a deeper look at the pros and cons of moving to monthly payroll.

Payday Super represents a major structural shift for business cash flow. Preparing early – by modelling payroll scenarios, adjusting forecasts and evaluating process changes – can prevent unnecessary surprises.

With the right strategies and genuine cash flow planning for Payday Super, you can integrate the new rules smoothly and without disruption.

If you would like support to understand what Payday Super will mean for your cash flow, we can help you:

If you are reading this before our webinar date, remember to register for Payday Super Changes: What Employers Need to Know Before July 2026 on Thursday 29 January at 1.00pm (AEST).

Reach out to us to book a Payday Super cash flow review, or start by reading our pillar guide What Is Payday Super And What Do Employers Need To Think About Now? for a full overview of the changes.

The introduction of Payday Super is one of the most significant changes to Australia’s superannuation system in recent years. From 1 July 2026, employers will be required to pay super at the same time as salary and wages, rather than quarterly.

While on the surface it may appear to be a simple timing adjustment, in reality Payday Super has far-reaching implications for how payroll, finance, HR and governance teams operate. It affects cash flow, systems, compliance and even the frequency with which you pay staff.

We recently ran a webinar covering the key changes and the playback is available: Payday Super Changes: What Employers Need to Know Before July 2026.

This guide explains what Payday Super is, how it will impact your business and the practical steps you should take now. It also links out to more detailed articles in each key impact area so you can dive deeper where you need to.

Payday Super is a change to the Superannuation Guarantee (SG) rules that will require employers to pay their employees super contributions at the same time as each pay cycle, rather than making contributions quarterly.

This means:

Super contributions will also need to reach the employee’s super fund within a short, legislated timeframe, currently set at within seven business days of each payday.

The aim of Payday Super is to:

Payday Superannuation was first announced by the Australian Government on 2 May 2023 as part of the 2023–24 Federal Budget.

Following consultation and exposure draft legislation in 2025, the Treasury Laws Amendment (Payday Superannuation) Bill 2025 passed both Houses of Parliament and received Royal Assent in early November 2025.

The new super rules commence on 1 July 2026. From that date, employers will need to pay Superannuation Guarantee (SG) contributions in line with each pay cycle and ensure those contributions are received by employees’ super funds within seven business days of each payment.

Payday Super applies to all employers who are required to pay SG contributions, covering eligible full time, part time and casual employees across all industries. This includes microbusinesses, small and medium businesses right through to large corporations.

On the surface, Payday Super sounds like a timing change. In reality it restructures how payroll and finance teams must operate and will change the way your payroll cycle, cash flow and compliance processes work together.

Under the current rules, employers have up to 28 days after the end of each quarter to pay superannuation contributions. With the new super rules, that window shrinks dramatically: payment must occur on or very close to payday. Super needs to be received by the employees’ superfund within 7 business days, leaving little room for:

What used to be a quarterly clean-up becomes a per-pay-run discipline.

Not all payroll platforms are currently capable of real-time super calculations or instant SuperStream-compliant reporting. Many businesses will need to:

If your current setup relies on manual uploads or batch processing, there is a high chance it will not cope well with the new superannuation rules without changes.

Quarterly payments allowed businesses to hold on to super amounts for weeks or months before paying them out. This will no longer be the case. Super is no longer something businesses can “catch up on” at quarter-end. Payday Super will particularly affect:

Under the new superannuation rules, the money leaves your account every pay cycle, so cash flow forecasting and liquidity management become far more critical.

With enhanced Single Touch Payroll (STP) reporting and more frequent SG data, the ATO will have far better visibility of:

Issues that might previously have gone unnoticed for months could be flagged quickly. This new level of scrutiny means processes that were “good enough” under quarterly super may no longer meet compliance standards.

To get a handle on what needs to change, it helps to look at Payday Super across four key impact areas. Each of these is covered in more detail in a supporting article.

More frequent super payments change the rhythm of your cash outflows. For many employers, this will require:

For a deeper look at how more frequent super payments will affect your working capital, read our guide Cash Flow Planning For Payday Super: How To Avoid Surprises. It steps through practical ways to model the impact and protect your cash position.

Payday Super increases the frequency of your super obligations and the speed at which the ATO can see if you are falling behind.

Areas to review include:

If you are concerned about penalties and ATO scrutiny under the new rules, our article “Payroll Compliance Under Payday Super: 10 Things Employers Can’t Ignore” explains the key obligations, common risk areas and how to tighten your payroll controls.

For some employers, Payday Super is prompting a rethink of how often staff are paid. Changing from weekly to fortnightly, or fortnightly to monthly, can affect:

More frequent payroll processing means more frequent SG contributions, approvals, reconciliations and bank runs. Less frequent payroll may reduce admin but could be unpopular with staff.

Our article “Payday Super And Payroll Frequency: Should You Move To Monthly Pay?” looks at the impact of monthly payroll cycles under the new super rules and outlines the pros and cons for different types of business.

Payday Super is not just a payroll tweak. It is an organisation-wide change that touches HR, finance, rostering, workforce planning, IT and governance.

Key areas to consider where changes might need to be implemented:

To understand these operational changes in more detail, see “Payday Super and Payroll Processes: The Changes You Need To Plan For”.

Once you understand the key impact areas, you can move into a structured readiness plan. Think of it as a roadmap from “current state” to “Payday Super ready”.

Confirm whether your current payroll software can:

If not, you may need upgrades or even a new system.

Before Payday Super goes live, simulate the full process:

This helps identify bottlenecks before compliance becomes mandatory.

Build a revised forecast model that includes more frequent super outflows.

Consider:

Quarterly review cycles will turn into per-pay-run controls.

You may need to update:

Everyone involved must understand:

“We’ll just handle it closer to the start date.”

Waiting until the last minute is risky. Payroll and software vendors will be under heavy demand as the deadline approaches. Early preparation will give you more options and less stress.

“Our payroll system will handle everything automatically.”

Many systems won’t be ready without updates or configuration changes – and some may not support real-time processing at all. It is important to test, not assume.

“It won’t affect our cash flow much.”

For most businesses, the shift from quarterly to weekly/fortnightly payments changes the timing of cash outflows significantly. Without planning, this can lead to pressure on working capital.

“The ATO won’t enforce this straight away.”

With enhanced STP data, the ATO will have immediate visibility of non-compliance. Fines and penalties may be applied consistently once the regime begins.

“Payday Super only affects payroll.”

It affects finance, HR, rostering, workforce planning and treasury. Treat it as an organisation-wide project, not a narrow payroll issue.

Payday Super is a change to the superannuation rules that will require employers to pay SG contributions at the same time as salary and wages, instead of making contributions quarterly. Contributions must also reach employees’ super funds within 7 business days after each payday.

The Payday Super rules are scheduled to start on 1 July 2026, giving employers time to prepare, test systems and update internal processes before the new regime begins.

Payday Super will apply to all employers who are required to pay Superannuation Guarantee contributions. It will cover eligible full time, part time and casual employees, regardless of business size or industry.

You will need to pay super each time you pay your employees. If you run payroll weekly, you will pay super weekly. If you pay fortnightly, you will pay super fortnightly. If you pay monthly, you will continue to pay super monthly, but must ensure contributions reach funds within the required timeframe.

Payday Super brings SG payments forward so money leaves your bank account more often. This reduces your ability to use accrued super as a short term cash buffer and makes cash flow forecasting, working capital management and access to finance more important.

Most employers will need to check that their payroll system can calculate SG in real time, send accurate STP data and submit contributions quickly through a clearing house or other service. You may require software upgrades, configuration changes or new integrations so that contributions reach employees’ super funds within the required time.

If you miss a Payday Super payment or contributions arrive late at the employee’s fund, you may be liable for Superannuation Guarantee Charge, interest and penalties. With more frequent data and clearer visibility, late payments are more likely to be detected and acted on.

Payday Super is more than a rule change. It is a structural shift in how Australian employers manage payroll, cash flow and compliance. Those who act early will transition smoothly. Those who delay may face operational challenges, cash flow disruptions, or compliance risks.

If you would like a tailored Payday Super readiness assessment for your business, get in touch and we’ll walk you through exactly what needs to change. We can help you:

For help preparing your business for the new super changes give the team at MGI South Qld a call on 07 3002 4800 or contact us online.

Remember to register for our webinar: Payday Super Changes: What Employers Need to Know Before July 2026 which is on Thursday 29 January at 1.00pm (AEST).

We work with businesses across Brisbane, the Sunshine Coast, Gold Coast and throughout SE Qld with all aspects of tax compliance.

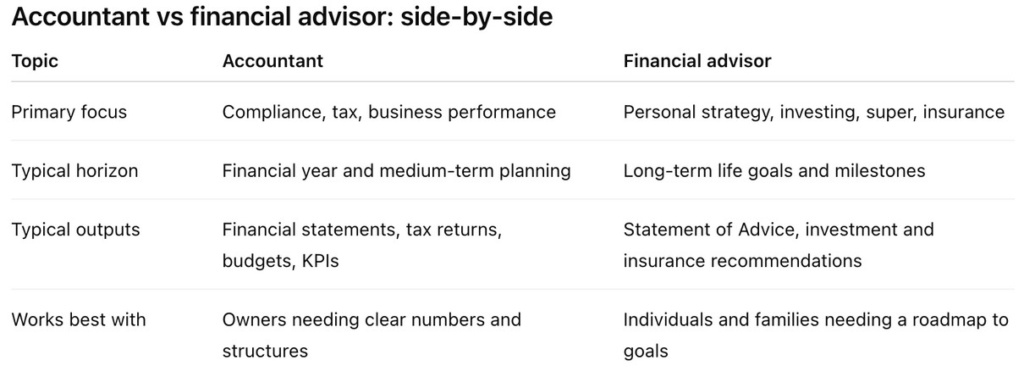

Do I need an accountant or financial advisor? It’s a question we get asked frequently. You want smarter money decisions, fewer surprises at tax time and a clear path to your financial goals. The question is who should be on your team. An accountant turns your numbers into compliant, dependable insights that help you run a better business. A financial advisor builds the strategy for wealth creation, superannuation and protection so you can reach life milestones with confidence.

We often get questions from our clients about the role of an accountant vs financial advisor. So we thought we’d explain the distinctions between the two roles, clarify what a financial planner does and show how the two work best together for business owners and families across South East Queensland.

When it comes to managing your finances, understanding the difference between an accountant and financial advisor is helpful. Each professional brings unique expertise to the table.

It’s also important to highlight that some accounting firms also offer business advisory services. This can include support in areas such as business coaching, business succession planning and external CFO services.

And full service accounting firms may also offer Audit and Assurance services that some organisations require to fulfill statutory and regulatory requirements.

For many individuals and business owners the best results come from a joined-up approach.

Accountants play a crucial role in the financial health of any business and help individuals and businesses stay on the right side of the Australian Taxation Office (ATO). Their main focus is on maintaining accurate financial records and using them to help you make better decisions. Typical areas include:

Explore more:

A financial planner, also known as a financial advisor (or adviser) creates a plan to help you achieve personal or family financial goals, then keeps you on track. They help guide your longer term financial strategies including investment management and retirement planning. Typical areas include:

Why it matters: Accountants keep the financial engine room accurate and efficient. Financial Advisors help you choose where the ship is heading and why.

For many people it is rarely either-or. The strongest outcomes come when your accountant and financial advisor work together:

Sometimes, the synergy of both an accountant and a financial adviser can significantly benefit your finances. Each professional brings unique expertise, ensuring comprehensive financial management.

Key collaborative benefits include:

Ultimately, leveraging their combined expertise helps ensure sustainable business growth and resilience.

An accountant is essential for most businesses, especially during periods of business expansion or restructuring. Their role ensures your financial operations align with regulatory standards and best practices.

A financial advisor is helpful for long-term financial planning and strategy development. Consider hiring one when you need guidance on investment opportunities, retirement planning, or wealth management.

Tip: Your accountant and financial planner can and should be linked up and communicate. Ask your financial advisor to share their plan with your accountant so structures and tax outcomes line up with the strategy.

Accountants often face the question: Can accountants give financial advice? The answer is yes, but it’s nuanced.

They primarily offer advice on tax efficiency and financial reporting. This includes suggesting ways to minimise tax liability.

However, their advice is usually centred around compliance and financial accuracy. It doesn’t typically include investment strategy or wealth management.

In summary, accountants can guide you on:

For broader financial planning, a financial advisor needs an Australian financial services (AFS) licence to be able to provide personal financial advice and recommendations. Both professionals can complement each other for optimal financial health.

Accountants focus on tax, compliance and business performance using your financial data. Financial advisors focus on long-term personal strategy, investments, superannuation and insurance.

Yes and it’s usually beneficial when your accountant and financial advisor collaborate and communicate to deliver optimum financial efficiency and outcomes.

No – accountants can give general tax-related guidance. Personal financial product and investment advice is provided by licensed financial advisers who issue a Statement of Advice.

Not usually. Only registered tax agents prepare and lodge tax returns for a fee. Your advisor and accountant should collaborate so recommendations are tax-aware.

Both professionals offer distinct benefits but, for many people, using them both usually results in better financial outcomes. When you are navigating significant changes such as business sale, retirement planning or significant investment changes, it’s always advisable to engage both an accountant and a financial advisor. The advisor sets strategy and the accountant optimises structure and tax.

Check credentials, be clear on scope and fees, and confirm how they will collaborate. Ask for an engagement letter from your accountant and a Financial Services Guide from your advisor.

As a full service accounting firm we offer the full range of accounting services to support business owners, professionals and families across South East Queensland including tax compliance, CFO advisory, business coaching and mentoring and audit and assurance.

We also have a network of professionals including financial advisors, lawyers and bookkeepers, that we can link our clients with to ensure a ‘joined up’ financial strategy.

At MGI we help businesses and individuals across SE Qld including Brisbane, the Gold Coast and Sunshine Coast with the full range of accounting and business advisory services.

Scion Private Wealth is a Brisbane financial advisor and a trusted referral partner of MGI South Qld. They support many of our clients with retirement planning, investment management, intergenerational wealth management and integrated tax planning services.

Whatever your financial needs, contact us today so we can help you to make smart, informed financial decisions.

Division 296 tax is a new superannuation tax measure that was introduced by the Australian Government, targeting individuals with super balances exceeding $3 million. Under this new tax measure, individuals with more than $3m super balance, will be subject to additional 15% tax on earnings associated with the portion of superannuation balances above the $3 million threshold. These earnings included both realised and unrealised gains whether the assets were sold or not.

After months of debate and industry feedback, the Government has finally revised its proposed Division 296 tax legislation. The changes reflect a more balanced approach to taxing high superannuation balances, with key updates that address concerns around fairness, practicality, and timing.

Super funds will calculate earnings based on taxable income, aligned with existing tax principles. There’s flexibility for funds to use a “fair and reasonable” approach, especially for large or complex funds. We will have to watch the space for more details around capping realised gains post 30 June 2026 and how the valuation methods will be applied to different asset classes.

Defined benefit pensions will now be valued using family law valuation methods, replacing outdated formulas. This change affects both SMSF and non-SMSF members and may significantly alter total super balance calculations.

To illustrate the impact of the new tiered Division 296 tax system, consider a member with a $12 million superannuation balance as at 30 June 2027.

Under the revised rules:

– 75% of the members’ super is over $3m ($12m – $3m is $9m, bringing it to 75% of total super balance of $12m), and

– 16.67% of the members’ super is over $10m ($12m – $10m is $2m, bringing it to 16.67% of total super balance of $12m)

– The fund generated a combination of general income and realised capital gains, of which $700,000 is attributed to the member. The fund has already paid 15% tax on this taxable income.

– $700,000 × 15% × 75% = $78,750

– $700,000 × 10% × 16.67% = $11,669

Total Division 296 tax payable: $78,750 + $11,669 = $90,419

This example highlights the importance of strategic planning for members with high superannuation balances to manage tax liabilities effectively.

While the revised Division 296 tax is a step forward, it still presents challenges – especially for those with super balances exceeding $10 million. The removal of unrealised gains from the tax base is a welcome relief, but the higher tax rate and complexity of earnings calculations mean strategic planning is essential.

Please reach out to MGI tax accountants and consultants if you have any questions or contact us on (07) 3002 4800.

When a business collapses only to reappear under a new name, it can raise serious red flags – especially if debts, taxes and employee entitlements have been left behind. This practice is known as phoenixing. While there are legitimate reasons for winding up and restructuring a business, illegal phoenix activity is a different story. It involves directors deliberately shutting down one company to avoid paying debts then starting a new entity to continue trading. The Australian Taxation Office (ATO) and regulators have a close focus on this practice, as it undermines fair competition and leaves creditors, staff and the community out of pocket. But what is phoenix activity and how can business owners identify and protect themselves from illegal operators?

The ATO and Australian Securities and Investments Commission (ASIC) are actively pursuing this issue. They are increasing scrutiny and enforcement actions against phoenix companies. As a business owner, knowing the signs of illegal phoenix activity can help you avoid potential issues that may leave you financially exposed.

The term phoenixing comes from the mythical bird, known for rising from its ashes but what is a phoenix business?

Phoenixing a company means resurrecting, restructuring or renewing it and describes companies that are liquidated only to be reborn as new entities. It refers to a company that is deliberately shut down and replaced by a new one, often with the same directors, to continue operating without the burden of previous debts.

Not all phoenix activity is unlawful. In some cases, directors may legitimately close a failing business and start again, provided they meet their obligations to employees, creditors and the ATO. The problem arises when this process is used to deliberately avoid paying debts. Illegally phoenixing a business typically leaves creditors, suppliers, staff and the community at a loss, while the directors continue trading through a fresh company.

Illegal phoenixing usually follows a clear pattern. A company is deliberately wound up with outstanding debts to the ATO, suppliers or employees. Its assets may be transferred to a related entity at little or no cost, while the directors quickly establish a new business that looks much the same as the old one. From the outside, it can appear as though nothing has changed – same staff, same premises, sometimes even the same trading name – yet the original debts are left behind.

This practice is most often seen in industries where cash flow is tight and competition is fierce, such as construction, labour hire, transport and hospitality. It allows unscrupulous directors to gain an unfair advantage by cutting costs they legally owe, while their competitors are left carrying the full burden of tax, wages and supplier payments.

The fallout extends far beyond the immediate business relationships. Employees can lose unpaid wages and superannuation, creditors are left chasing debts that will never be recovered, and the broader economy suffers when millions in tax revenue is lost.

There are some common tactics employed in a phoenix company that can be red flags to be aware of and help protect your business both financially and reputationally.

Records might be obscured or destroyed, making it difficult to trace financial histories. This deliberate concealment complicates investigations and recovery efforts. Affected parties, including the ATO, struggle to reclaim outstanding debts. This results in significant economic losses and undermines the integrity of honest businesses.

Illegal phoenixing often leaves others to pick up the pieces, but there are steps that businesses can take to reduce their risk.

For directors themselves, the best protection is to stay compliant. This means maintaining accurate records, lodging tax returns on time, paying employee entitlements and seeking professional help if financial difficulties emerge. Acting early often opens up more legitimate restructuring options and reduces the risk of breaching the law.

Engaging professional advisers can also help. They offer insights into potential risks and ensure you aren’t unwittingly involved with a phoenix company. Taking proactive measures can help avoid financial harm for your own business.

Illegal phoenixing is a significant issue in Australia, costing the economy billions each year. It affects small business owners who may unknowingly engage with phoenix companies. In fact, according to the ATO illegal phoenix activity costs the economy in the region of $4.89 billion annually.

Because of the damage it causes, illegal phoenix activity is a top priority for regulators. The Australian Taxation Office (ATO), ASIC and other government agencies work together to detect and prosecute directors who attempt to walk away from their obligations.

Illegal phoenix activity distorts fair competition, allowing dishonest companies to undercut rivals who fulfil their obligations. For small businesses, the ripple effects can be devastating. Suppliers and contractors might face unpaid invoices, affecting their cash flow and sustainability. This financial strain can lead to broader economic issues, including job losses.

It is important to understand that not every business that closes and starts again is acting illegally. Sometimes companies genuinely face financial difficulty and need to restructure to survive. If handled correctly, this process can be completely lawful and even in the best interests of creditors and employees.

The distinction lies in intent and compliance. Legal restructuring follows proper processes, such as voluntary administration or liquidation, with assets sold at fair value and proceeds distributed to creditors in line with the law. Employees are paid their entitlements and directors meet their reporting and tax obligations.

Illegal phoenixing, on the other hand, occurs when directors deliberately avoid these responsibilities. Assets may be transferred for less than market value or not recorded at all, creditors and staff are left unpaid, and the directors attempt to carry on trading as if nothing has happened.

By recognising the difference, business owners can ensure they restructure in a way that is both compliant and transparent, avoiding the serious penalties linked to illegal phoenix activity.

Having a business partner you can trust in your corner can reduce stress and anxiety if you suspect you’re in business with phoenix operators. Our team can:

By working with us, you can get timely advice on the correct steps to take should you fall victim to scam operations. If you are concerned about potential exposure to phoenix activity – whether within your own company or through dealings with others – our advisors are here to help you take the right steps.

Understanding phoenix activity is crucial for protecting your business. Staying aware enables you to minimise the risks of doing business with illegal operators.

Here are important points to keep in mind:

These practices help avoid unintentional involvement in illegal phoenix activities. They also safeguard your business interests and reputation.

The Australian Government has mandated sustainability reporting starting from 1 January 2025 for certain entities. The Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill 2024, which amends the Corporations Act 2001, requires entities to include sustainability reports in their annual reports if they meet certain criteria. Let’s take a look at the Australian Sustainability Reporting Standards, specifically AASB S2, the climate disclosure standard and what it means for your organisation.

Australian entities required to prepare and lodge a financial report with the Australian Securities and Investments Commission (ASIC) under Chapter 2M of the Corporations Act 2001 must prepare a sustainability report if they meet certain criteria (see table below)

Whilst Group 1 companies are at the larger end of town, MGI South Qld works with a number of Group 2 and Group 3 companies that will be impacted by this legislation.

These companies are required to provide a sustainability report from financial year 2027 and 2028 for Group 2 and Group 3 entities respectively. This report should include:

Climate Statements must include information on climate-related risks and opportunities in line with AASB S2 – Australian Sustainability Reporting Standard. This requires information to be provided on the following:

*Scope 1 covers direct emissions from owned or controlled sources, such as Company -owned vehicles or industrial processes. Scope 2 encompasses indirect emissions from purchased electricity, steam, heating, and cooling. Finally, Scope 3 includes all other indirect emissions that occur in the value chain, such as those from suppliers or the use of products.

AASB S2 requires entities preparing sustainability reports to only utilise all reasonable and supportable information available to them as of the reporting date, provided it can be obtained without undue cost or effort. Accordingly, when reporting Scope 3 GHG emissions, entities are not expected to provide exact data or detailed information that is unduly difficult or costly to obtain from other entities along its supply chain. ASIC has clarified that reporting entities are permitted to use estimation in measuring Scope 3 GHG emissions, and can use primary or secondary data or a combination, noting that accuracy of estimation may improve over time.

Scenario analysis will also be required to be carried out and reported against, for at least the following two scenarios:

ASIC also provides additional guidance on the intent of the scenario analysis requirements, being: ‘to ensure that users have the benefit of information about the reporting entity’s climate resilience and material financial risks and opportunities relating to climate that are informed by a scenario that: (a) contemplates rapid global decarbonisation in the near term (lower global warming scenario); and (b) contemplates more pronounced climate impacts over the medium to long term‘

According to AASB S2, entities are not required to disclose commercially sensitive information about climate-related opportunities, ensuring they can protect economic interests.

The sustainability report will need to be approved by the Directors, provided to members at an AGM and lodged with ASIC. This report will also be required to be audited.

MGI South Qld audits a number of companies that will be impacted by the changes to the ASRS standards and has the skills and expertise to provide this additional auditing requirement in the future.

If your current audit provider is unable to provide this additional service, or you are simply looking to review your auditing requirements against the market, please contact us today for a complimentary and no obligation discussion about your auditing services.

For the 2025/26 Aged Care Finance Report, aged care providers are required to prepare a new Care Minutes Performance Statement, which must be audited by your external auditor.

The following data will be needed to complete your Care Minutes Performance Statement:

In addition, you must continue to report care minutes and 24/7 RN coverage through the Quarterly Financial Report and 24/7 RN Reporting.

The audit must be conducted by a registered company auditor under the assurance standard ASAE 3000 Assurance Engagements Other than Audits or Reviews of Historical Financial Information.

You will need to:

MGI South Qld audits a number of not for profit and for profit aged care providers, and has the skills and expertise to provide this additional auditing requirement.

If your current audit provider is unable to provide this additional service, or you are simply looking to review your auditing requirements against the market, please contact us today for a complimentary and no obligation discussion about your auditing services.

"*" indicates required fields

MGI South Qld is one of the leading Brisbane accounting firms. Our team of business accountants, auditors and advisors support organisations across South East Qld including the Gold Coast, Sunshine Coast, the Darlings Downs and Wide Bay & Burnett region.

MGI refers to one or more of the independent member firms of the MGI international alliance of independent auditing, accounting and consulting firms. Each MGI firm in Australasia is a separate legal entity and has no liability for another Australasian or international member’s acts or omissions. MGI is a brand name for the MGI Australasian network and for each of the MGI member firms worldwide. Liability limited by a scheme approved under Professional Standards Legislation.

Enter your details to access the guide

Select your desired option below to share a direct link to this page.

Your friends or family will thank you later.