Following the recent passing of legislation to extend JobKeeper, Treasury has provided further detail surrounding eligibility and payment details.

Am I eligible?

To be eligible for the Jobkeeper extension under the basic test your business must have experienced an actual decline in turnover of:

- 50% for those with aggregated turnover of more than $1 billon.

- 30% for those with an aggregated turnover of $1 billon or less

- 15% for Australian Charities and Not for Profits Commission-registered charities (excluding schools and universities)

In some situations, your business may still be eligible under an alternative test depending on your circumstances. The details of the alternative tests are being finalised by the Tax office. Please contact us if you wish to discuss.

What is the turnover period?

Businesses will satisfy the actual decline in turnover test if your current GST turnover for quarter ending 30 September 2020 has declined in comparison to the same prior-year period (30 September 2019). If you satisfy the turnover test, you are eligible to continue JobKeeper until 3 January 2021.

In order to get a further extension of JobKeeper until 28 March 2021 – your business will have to re-test and demonstrate an actual decline in GST turnover for quarter ending 31 December 2020 compared with the same prior year period (31 December 2019).

Changes to employee eligibility

As of the 3rd August 2020, the key date for assessing employee eligibility is now 1 July 2020. This will capture employees who may have started in your business between 1 March 2020 and 1 July 2020.

Employees that were eligible as at 1 March 2020, will continue to be eligible going forward.

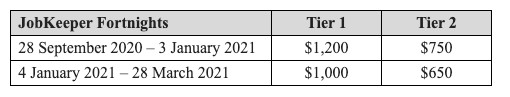

Changes to Jobkeeper payment rates

From the 28 September 2020, there will be two payment rates – a tier 1 and tier 2 rate – which will be stepped down in two stages, see below.

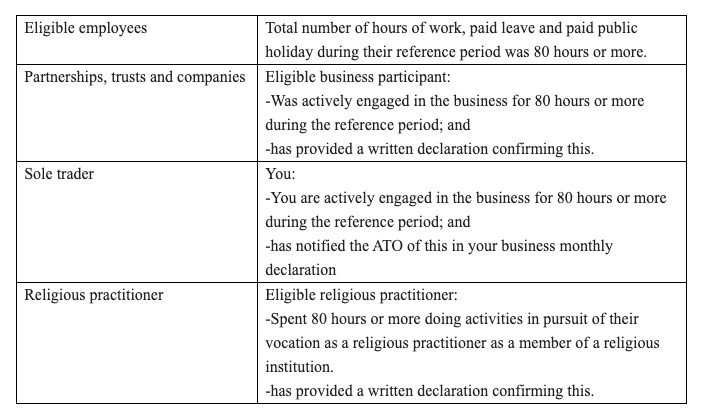

An employee’s entitlement to Tier 1 or Tier 2 payments is based on whether they meet the 80-hour threshold.

An employee or business participant/religious practitioners is entitled to the Tier 1 rate if the 80-hour threshold is satisfied. If they do not meet this threshold they are eligible for Tier 2 payment rate.

80-Hour Threshold

There are two steps to satisfying the 80-hour threshold:

1. Determine the individuals reference period

For eligible employees – 28 days finishing on the last day of the last pay period that ended before either 1 March 2020 and 1 July 2020. If the employee was working during both 28-day periods you will need to consider both reference periods.

If you are looking to qualify as a Business Participant, the reference period is the month of February 2020.

In some circumstances, an alternative reference period can apply if the standard period (above) is not suitable.

There may be more than one reference period that applies to an individual – if the employee satisfies the 80-hour threshold in any reference period then Tier 1 applies

2. Apply the 80-hour test

Generally, a full-time employee who has been employed for their full 28 day reference period will satisfy the 80-hour threshold.

Further consideration is required for employees that are part-time, long-term casual, not paid on an hourly basis or stood down

28-day reference period

The 28-day reference period or periods are based on when the pay cycle ends and therefore won’t be the same for all employers.

Use either:

- the pre-March period which is the 28 days which finish on the last day of the last pay cycle that ended before 1 March 2020, or

- the pre-July period which is the 28 days which finish on the last day of the last pay cycle that ended before 1 July 2020.

Your pay cycle for an employee may not be the same as the period between the days you actually pay them. For example, the amount you pay an employee each Friday may be for the hours worked in a week ended on the previous Wednesday – in this case the pay cycle is the week ended on the Wednesday.

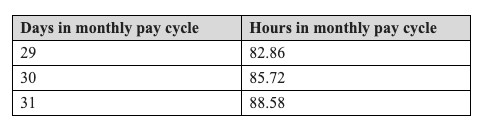

If your pay cycle is longer than 28-days (for example monthly), a pro-rata calculation will need to be performed.

Example – determining the reference period:

Callum runs a business and has 10 employees.

The business has a fortnightly pay cycle, which ends every second Wednesday.

In February 2020, the pay cycle for Callum’s business ended on the 5th and the 19th.

The pre-March period of Callum’s employees is the 28 consecutive days ended on the 19 February (being the 23 January to the 19th January).

In June 2020, the pay cycles for Callum’s business ended on the 10th and 24th.

The pre-July period for Callum’s employees is the 28 consecutive days ended on the 24th June. The reference period is the 28th to May to 24th June

If any of his employees do not meet the 80-hour threshold for the pre-March and pre-July periods he should consider applying an alternative reference period.

Please contact us should you wish to apply an alternative reference period.

What doesn’t change?

You do not have to re-enrol for the extension if you are already enrolled prior to 28 September.

You do not need to re-assess employee eligibility if you are already claiming for them before 28 September.

You do not need to meet any further requirements if you are claiming for an eligible business participant.

Notifying the ATO

From the 28th September, you will need to notify the ATO of the following:

- Actual GST turnover reduction

- Which Tier will apply for all eligible employees/business participants/religious practitioners

We expect that the identification process will be a declaration via the Business portal or lodgement through a tax agent

Within 7 days of notifying the ATO of the Tier rate, you must also notify each individual employee in writing of their rate.

Further Information

Please contact the team at MGI South Queensland if you wish to discuss your personal circumstances.