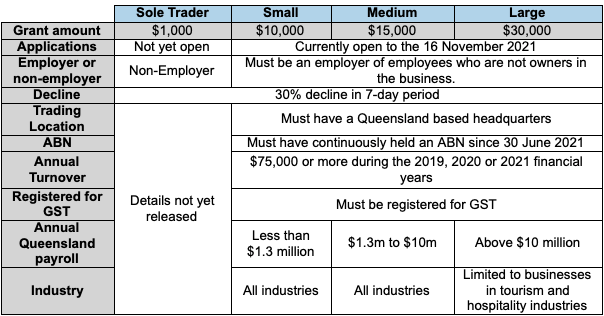

The 2021 COVID-19 Business Support Grant for lockdown-impacted businesses in Queensland is now open to applications (except in relation to the $1,000 grant for non-employee sole traders). While it was originally announced as a $5,000 grant, the grant support has been increased. Below is a summary of the grant amounts and eligibility conditions.

The 30% turnover (i.e. income) decline is based on a nominated 7-day period with comparing to the same 7-day period from 2 years ago (or an alternative 7-day period if that isn’t situatable). The nominated 7-day period must include one full day of the lockdown periods in July & August 2021. Your business doesn’t necessarily need to have been in one of the lockdown zones, it just needs to show it is in Queensland and it had the 30% decline in the nominated period.

The application for the grant is online only and must be completed by the business and not their advisers. As part of the application, evidence is required from various records from your bookkeeping records (e.g. BAS, payroll reports, BASs, income reports). Alternatively, a letter can be provided by your accountant instead to advise these details instead or we can assist with getting the records from your bookkeeping records.

Importantly, it has been announced that funds will be provided to all successful applicants, so the grant isn’t limited to a certain cap. Once a grant application is successful approved, the funding will be paid within 2 weeks of the approval.

The non-employing sole trader grant of $1,000 is not currently open for applications but you can currently register your interest to receive updates from the Queensland Government. If you are sole trader but have employees, you should consider the small, medium or large grants instead.

For further information, please contact MGI or see the details on Queensland Government website below.

https://www.business.qld.gov.au/starting-business/advice-support/grants/covid19-support-grants