Subscribe for Our Latest Resources

"*" indicates required fields

As the 2024 end of tax year approaches, the Australian Tax Office (ATO) is sharpening its focus on several key areas to ensure compliance and integrity within the tax system. This year, the ATO is particularly vigilant about claims for rental property deductions, work-related expenses, and undeclared income from the sharing economy. If you’re preparing for tax time, understanding and ensuring you’re fully compliant in these areas can help ensure you get your lodgment right the first time. Let’s take a look at the ATO focus areas for 2024 in a bit more detail.

Investment properties were a firm focus at tax time in 2023 and the ATO continues to scrutinise rental property deductions closely, ensuring that claims are legitimate and accurately reflect expenses incurred. Recent audits from the tax office indicate that 90% of rental property owners are getting their tax returns wrong.

According to ATO Assistant Commissioner, Robert Thomson: “People aren’t apportioning correctly between interest relating to private use and the interest that relates to the income they’re generating from their investment property.”

Common areas where taxpayers might encounter issues include:

The ATO employs sophisticated data-matching techniques and collaborations with financial institutions to identify discrepancies and ensure compliance. Rental property owners should maintain detailed records and seek professional advice to ensure their claims are accurate and justifiable.

Work-related expenses are another area under the ATO’s microscope. This was another key focus from last year that remains a priority for the ATO. Changes were made last year to the fixed rate method of calculating a working from home deduction and taxpayers were required to keep more detailed documentation. However, this is the first full year of these changes being in effect so the expectation is that you must have comprehensive records to substantiate your claims.

“Copying and pasting your working from home claim from last year may be tempting, but this will likely mean we will be contacting you for a ‘please explain’. Your deductions will be disallowed if you’re not eligible or you don’t keep the right records.” Mr Thomson said.

To avoid issues, taxpayers should adhere to the following guidelines:

Accurate record-keeping and adherence to ATO guidelines are essential to ensure compliance and avoid audits or penalties.

The rise of the sharing economy has introduced new challenges for tax compliance. Platforms like Airbnb, Uber, and various freelancing sites have made it easier for individuals to earn income that may go undeclared.

The ATO is particularly focused on:

The ATO collaborates with sharing economy platforms to access data and identify undeclared income. These sophisticated data matching systems mean that if you decide to not report your income from these platforms then you are much more likely to trigger a review by the ATO. Participants in the sharing economy should maintain comprehensive records of their earnings and report them accurately to avoid penalties.

The advice is also to not rush to submit your tax return, particularly if you received income from multiple sources. “By lodging in early July, you are doubling your chances of having your tax return flagged as incorrect by the ATO.”

As the ATO intensifies its focus on rental property deductions, work-related expenses, and undeclared income from the sharing economy, it is more important than ever for taxpayers to be diligent and compliant. By understanding these key areas and maintaining accurate records, taxpayers can navigate their obligations confidently and avoid the risk of audits and penalties. If in doubt, seeking professional advice from the tax experts at MGI can provide the necessary guidance to ensure compliance and peace of mind in the 2024 tax year.

Check out our recent blog on Personal Services Income (PSI) to ensure that you are categorising your business and services correctly.

For more information or personalised advice on your tax obligations, feel free to reach out to the experts at MGI South Qld. We’re here to help you navigate the complexities of the Australian tax system with ease and confidence.

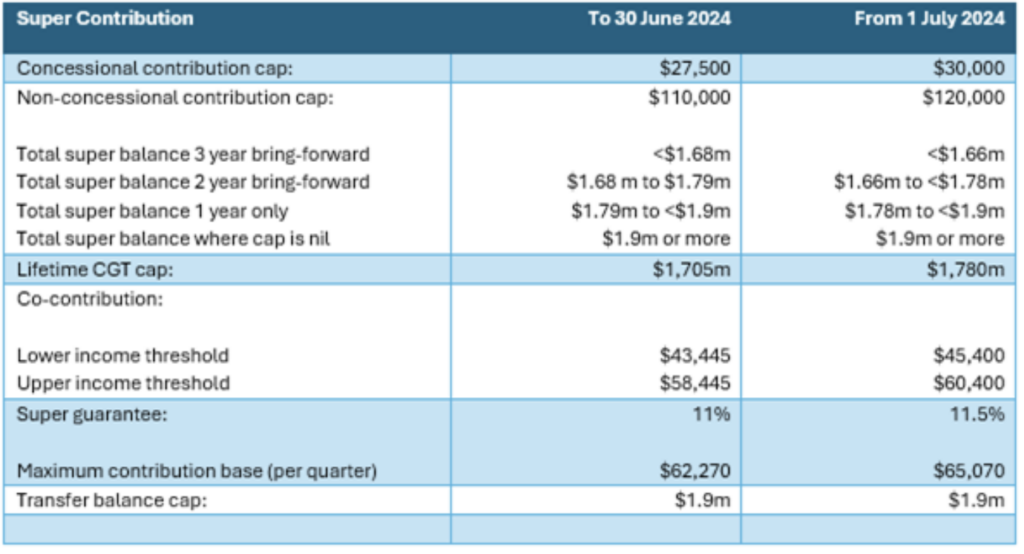

Following on from our post a couple of months ago about tax and superannuation deadlines the following are the upcoming contribution cap and superannuation changes.

1. Contributions – cap increase

From 1 July 2024 a number of rates and thresholds will increase, including the contribution caps. There has been no further indexing of the transfer balance cap so there will be changes to the eligibility to use the 3 year bring forward non-concessional contributions (see table below).

A reminder to review any salary sacrifice agreements to avoid excess concessional contributions with the increase in super guarantee to 11.5% from 1 July 2024.

2. Defined benefit interest (CSS/PSS) calculation for Division 296 – in relation to superannuation balances above $3million

From 1 July 2025 tax concessions will be reduced for certain earnings for superannuation balances above $3 million. On 28 February 2023, the Australian Government announced from 1 July 2025 a 30% concessional tax rate will be applied to future earnings for superannuation balances above $3 million, known as Division 296.

If you are wondering how the balance of your CSS or PSS pension will be calculated for the purposes of the proposed Division 296 tax you will need to wait a little longer.

While draft legislation has been released, the calculations for determining the balance of defined pensions will be contained in the regulations which no one has seen (or possible written).

3. Reminder about the changes in Small Business Super Clearing House

From 15 March 2024, the ATO will introduce SMSF bank account validation in the Small Business Superannuation Clearing House (SBSCH). This will require any small employer using the SBSCH to ensure that their employees’ SMSF bank accounts match the bank account details registered with the ATO for contributions.

If you are receiving contributions via SBSCH or using the SBSCH to pay employer contributions, it is important to contact employees to confirm that the SMSF bank account that superannuation contributions are paid to, is the same as the SMSF bank account registered against the superannuation role, with the ATO. A mismatch will mean that their superannuation contributions can’t be processed through the SBSCH.

This also applies for any member roll-in and roll-out requests.

Please contact us if you need to check the details of the bank account registered with the ATO for your SMSF.

Proactive steps are essential to ensure any SG obligations for the March 2024 quarter can be met by 28 April 2024.

4. Non-Arm’s Length Income/Expense (NALI/NALE) Bill Passed Through Parliament

An important reminder to the trustees and the members of the fund, that NALI/NALE bill has now passed through both houses of Parliament and it is essential to review all general expenses incurred/not-incurred within the fund.

It is crucial to understand and review transactions within the superfund that there is no expenditure at non-arm’s length that will trigger the rules concerning non-arm’s length income.

This rule specifically dives into general expenses such as discounted accounting or adviser fees, legal fees or any other general expenses which are non-arm’s length.

If you have any queries or concerns or need further advice and support about superannuation changes please don’t hesitate to reach out to the team at MGI.

Personal Services Income can be a confusing topic, particularly if you’re a sole trader. However, it’s vital to understand what it is so you know what tax deductions you can claim. Personal Services Income (PSI) is a concept introduced by the Australian Taxation Office (ATO) to govern how income from personal services is reported and taxed. PSI is particularly relevant for independent contractors, freelancers, and consultants who provide their professional or technical expertise. The ATO’s guidelines around PSI help ensure that individuals who earn a significant portion of their income from their personal efforts or skills pay the appropriate amount of tax. So what is personal services income? In this blog we’ll explain the PSI rules, outline how it is calculated and explore its impact on tax deductions.

Personal Services Income refers to income that is primarily generated from your personal skills or efforts as an individual. According to the ATO, income is classified as PSI if more than 50% of the amount you received for a contract was for your labour, skills or expertise. The concept is usually applicable to knowledge-based services such as:

However, it doesn’t apply if your income is generated from the use or sale of a product, the use of an income-producing asset or other business structures involving more than just personal effort.

Jayne is a marketing consultant operating as a sole trader. She has two clients who she has recently completed work for.

Client 1: Jayne delivered a Marketing Strategy training session for her client. She charged the client $1,500 for the session which included materials that cost $150. That means that $1,350 or 90% of the work was for her personal skills and knowledge and should be classified as PSI.

Client 2: Jayne provided email marketing software for a client for which she charged $5,000. The cost of the software licence was $4,000 and the remainder was for her skills and expertise in setting up the software for the client. Since only 20% of the cost was for her expertise, this is not classified as PSI.

While your taxable income can be a mix of PSI and non PSI you should establish whether you are a personal service business (PSB) in the year that you received the PSI income as this affects the deductions you can claim.

The PSI rules are in place to determine how income is reported and what deductions are permissible. The purpose of these rules is to prevent individuals from diverting their income through companies, partnerships or trusts to exploit lower tax rates. Essentially, if the PSI rules apply, the income is treated as personal income and taxed at individual tax rates.

To determine if the PSI rules apply to you, the ATO applies a series of tests:

If you fail these tests, you need to treat your income as PSI and comply with the relevant tax implications.

The Personal Services Income (PSI) rules were introduced by the Australian Taxation Office (ATO) to address tax avoidance issues associated with the income earned primarily from the personal skills or efforts of an individual. Essentially the rules ensure that contractors pay similar amounts of tax as those who are employed, preventing them from gaining tax advantages by diverting their income through companies, trusts, or partnerships. The PSI rules now prevent the misuse of business structures for the purpose of tax minimisation.

Before the PSI rules, individuals could reduce their tax liability by channeling their income through such entities. These entities would then potentially claim deductions that would not normally be available to an individual, or split income among various members to reduce the overall tax rate. This approach could substantially lower the tax obligations compared to what an individual might pay if taxed at personal income rates.

Calculating your PSI involves identifying all income received from personal efforts and applying the relevant PSI rules to determine your taxable income. If the PSI rules apply, you will need to attribute all income and deductions to yourself, regardless of whether your business structure involves other entities.

The PSI determination directly influences how you claim deductions. Generally, deductions are allowed for expenses incurred in generating PSI, including:

However, certain deductions, typically available to businesses, may not be claimable if they do not directly relate to the earning of PSI. These may include rent, occupancy expenses, or salaries paid to associates who do not contribute directly to contract fulfilment.

For professionals and freelancers, understanding PSI is crucial to ensuring compliance with ATO guidelines and optimising tax obligations. Here are the main points to remember:

By understanding and adhering to the PSI rules, individuals can better navigate their tax obligations and plan their financial affairs accordingly. For further guidance, consulting a tax professional or visiting the ATO’s website can provide additional clarity and personalised advice.

This overview should serve as a starting point for anyone dealing with PSI and aiming for a compliant and optimised tax handling of their personal services income in Australia.

If you require assistance with understanding your tax obligations and ensuring you claim the correct tax deductions, our team of expert business tax accountants can help.

To help you plan, we have included the important upcoming superannuation and tax deadlines and dates as a reminder.

31 March 2024 – Large tax payers (Turnover > $2Million) 2023 Tax Return lodgement and payment due date

For Companies or Superfunds that had a turnover of more than $2Million in their prior year’s tax return, your 2023 Tax Return is due for lodgement and payment 31st March 2024. If you feel that you will have any difficulty in making your 2023 tax return payment, please contact MGI to discuss your payment options.

15 May 2024 –2023 Tax Return lodgement and payment due date

For the majority of tax payers, the 2023 Income Tax Return is due for lodgement and payment by 15th May 2024.

If you are an MGI client and have not yet provided us with your 2023 tax work information, please don’t hesitate to contact us to discuss what information we require to complete your annual tax work, alternatively please don’t hesitate to send through your information directly to your MGI contact and we will let you know what further information we may require. MGI will be touching base with our clients to request your annual tax work. This due date is still a few months away, however if your 2023 tax work has not yet been started, please reach out to us to get your work scheduled for completion within the next few months.

If we have already completed your 2023 annual tax work, can you please ensure that you have returned the signed documentation back to our office for filing so that we can lodge your returns by this due date. If you unfortunately have to make a payment to the Tax Office, that payment due date is also 15 May 2024. If you feel that you will have any difficulty in making this payment by this due date, please don’t hesitate to touch base with us to discuss your payment options.

31 March 2024 – 2024 FBT year-end date

The FBT year runs 1 April – 31st March, if you are an FBT client we will be touching base with you in late March 2024 to discuss your FBT requirements and to start on requesting information with respect to the completion of your annual FBT returns. Don’t forget to record your vehicle speedo readings as at 31 March 2024, which is a requirement from the ATO for business clients to keep records of.

The 2024 FBT Return payment and lodgement due date is 25 June 2024, however to ensure we have ample time to complete our client’s returns before this due date we will be touching base as early as possible so please keep an eye out for correspondence from our office with respect to your FBT lodgement requirements.

April – June 2024 – End of Year & Tax Planning

We will be touching base with our Tax Planning clients in early April to get started on our annual tax planning process. Tax Planning is very important as it can help make you aware of you upcoming tax liabilities and also gives you an opportunity to implement strategies that can help you reduce your tax implications. The earlier we are able to complete your tax planning the better, as this gives you ample time to review your options and implement any strategies before 30 June. As such, we do ask our Tax Planning clients to have their year-to-date information (1 July 2023 – 30 April) up to date in their accounting software so that we can complete our tax planning calculations when the time comes.

30 June 2024 – Deadline for Employee Superannuation Payments

Employee Superannuation is tax deductable when it is paid and only if paid on time. Superannuation must be paid at least quarterly by the following due dates:

If you are wanting to maximise your Superannuation deduction for the 2024 Financial Year, you will need to make any June 2024 quarter payments before 30 June 2024.

The above tax deadlines are only general reminders, but if you have any queries or concerns, please don’t hesitate to reach out to the team at MGI. Also take a read of our recent blog on the ATO’s areas of focus for 2024.

Are you having a staff Christmas Party? With the festive season just around the corner, the ATO has reminded employers to consider the fringe benefits tax (FBT) implications of the party or other event. So what are the FBT implications of the office Christmas party?

This will depend on a number of factors:

It is important to keep all records relating to the entertainment-related fringe benefits you provide, including how you worked out the taxable value of benefits.

You need to be sure you really understand how FBT works, otherwise you could end up with a heft FBT liability.

Christmas parties constitute “entertainment benefits” and to the extent that the expenditure relates to employees or their associates attending the function, the expenses may be subject to fringe benefits tax (FBT) unless an exemption (eg, the “minor benefits” exemption) applies.

A minor benefit is one that is provided to an employee or their associate (eg, spouse) on an “infrequent” basis, which is not a reward for services, and at a cost less than $300 (inclusive of GST) “per benefit”.

Entertainment expenses are not tax-deductible unless they are subject to FBT. This means that expenses incurred in providing a Christmas party are not generally deductible where the minor benefit FBT exemption applies.

Non-entertainment benefits provided to employees at the Christmas party, such as a hamper, are considered separately when applying for the $300 minor benefits exemption. Although the total cost per person is more than $300, each benefit should be considered separately under the minor benefits exemption.

If the business gives employees non-entertainment type gifts that cost less than $300 (inclusive of GST) per employee, then the cost is fully tax-deductible, with no FBT payable and GST credits can be claimed. The gifts at Christmas parties are usually exempt from FBT because they are not provided on a regular basis, and the gift is not provided to the employees wholly or principally as a reward for their services rendered.

Unlike non-entertainment gifts, gifts classified as entertainment, including recreation, are non-deductible and GST credits cannot be claimed. A tax deduction and GST credits can only be claimed on entertainment or recreation gifts where Fringe Benefit Tax applies. This means that while the minor and infrequent exemption could still apply for entertainment and recreation gifts costing less than $300 (GST inclusive), tax deductions and GST credits can only be claimed where FBT applies to entertainment and recreation gifts.

The costs (such as food and drink) of a Christmas party are exempt from FBT if they are provided on a working day on your business premises and consumed by current employees. If spouses or other guests of employees are entitled to attend, there could be an FBT liability unless the cost is covered by the minor benefits exemption.

This is general information above, but for specific FBT implications and tax advice, please talk to the team at MGI.

The Government has released draft superannuation legislation for the proposed new tax on members with more than $3m in super – known as “Division 296 tax”.

The Federal Government hasn’t moved from its original direction and so the unpopular elements remain:

Earnings is essentially movement in a member’s total superannuation balance adjusted for net contributions and withdrawals.

Earnings will be specifically adjusted to reflect the fact that increases in a member’s balance arising from inheriting super pensions, receiving transfers from a partner or ex partner’s superannuation (under a contribution split or family law split) and insurance payouts are not earnings and shouldn’t be subject to the tax. Interestingly, even some amounts allocated from reserves will be excluded from earnings.

The Government will not chase deceased members for Division 296 taxes that would otherwise be incurred in the year of death. A member who dies before the end of the year will be deemed to have a $nil tax regardless of what’s happened to their super during the year. If their balance has been left in super but transferred to a spouse (for example, a reversionary pension or a death benefit pension) it will be counted in the inheriting spouse’s $3m. So, this is only relevant for people whose super is still waiting to be dealt with at the end of the year.

The Bill reduces the tax concessions for individuals with a total superannuation balance (TSB) above $3 million by imposing an additional 15 per cent tax on certain earnings under Division 296 of the Income Tax Assessment Act 1997.”

The tax will be levied on individuals but can be paid from a super fund using the usual release authority mechanism.

Treasury has invited responses to the draft legislation, but there’s a very short turnaround required (18 October 2023), suggesting major changes are not expected.

MGI SQ will provide further updates in due course on the legislation. In the meantime if you have any queries please don’t hesitate to contact us.

Ownership of cryptocurrency has been on the increase in Australia for a number of years now. But many people are confused about what impact this has from a tax perspective. The tax implications of digital currencies can be complex so we’re going to take a look at crypto tax in Australia if you’re an investor, not a trader. If you’ve considered investing in it, we’ll also explore under what circumstances Capital Gains Tax (CGT) is payable along with other potential tax consequences of owning cryptocurrency. Do you have to pay tax on cryptocurrency in Australia? Let’s take a look…

Cryptocurrency is a type of digital or virtual currency that uses cryptography for security. It operates on a technology called blockchain, which is a decentralised and distributed ledger that records all transactions across a network of computers. Unlike traditional currencies issued by governments (such as the Australian Dollar), cryptocurrencies are typically not controlled by any central authority, like a central bank. Bitcoin, Ethereum, and Ripple are some well-known examples of cryptocurrencies.

In Australia, cryptocurrency regulation has evolved over the years, and it’s important to note that regulations can change, so it’s essential to stay updated with the latest developments.

The Australian Taxation Office (ATO) treats cryptocurrency as property for tax purposes. This means that individuals and businesses are required to pay capital gains tax on cryptocurrency transactions, depending on the profits they make.

When you sell a cryptocurrency asset you need to work out whether you made a capital gain (i.e. you made a profit) or a capital loss (i.e. you lost money) to determine how much capital gains tax (CGT) you’re required to pay. You need to report your gains and losses in your Income Tax Return and pay income tax on net gains.

Crypto disposal is considered a ‘CGT Event’ by the ATO however ‘disposal’ doesn’t simply mean sale of your cryptocurrency. It also includes:

Cryptocurrency transactions are also subject to goods and services tax (GST) in some cases.

If you receive cryptocurrency as payment for goods or services, it’s considered part of your taxable income and should be declared on your tax return at its Australian dollar value at the time you receive it.

Crypto-to-crypto trades are also taxable events. It’s important to understand that when you trade one cryptocurrency for another, it is considered a disposal for tax purposes, and any capital gain or loss needs to be reported.

Mining cryptocurrency is also considered a taxable activity, and the mined coins are subject to taxation.

However, the ATO views cryptocurrency used for personal use (e.g. buying a product), sometimes referred to as Personal Use Assets differently than cryptocurrency kept as an investment. These distinctions can greatly affect tax obligations. We cover this in more detail below.

The ATO now has sophisticated data matching techniques in place for Cryptocurrency trades or exchanges. It’s likely that they already have your information if you have an account with an Australian Designated Service Provider (DSP) as they have access to the Know Your Customer information supplied when you signed up for an Australian exchange or wallet.

In addition, the ATO has specific guidance and tools for cryptocurrency tax reporting, including the use of cryptocurrency tax software.

It’s vital to understand that attempting to avoid or evade cryptocurrency taxes in Australia is illegal and can lead to penalties and fines.

It’s important to recognise that you cannot avoid paying tax on crypto currency in Australia however there are some measures that you can take to reduce the tax payable. You have to declare crypto in your tax return if you have sold, traded or earned it in the past financial year.

However, one of the ways to potentially reduce your CGT tax liability is to hold on to your investments for more than 12 months before selling. You may then be eligible for a 50% discount on the CGT tax payable.

In addition there is the Personal Use Asset exemption. Cryptocurrency is considered a personal use asset if you keep or use it mainly for personal use and it was purchased for less than $10,000. The most common situation of personal use of crypto assets is to buy items for personal use or consumption. If the crypto is considered a personal use asset, a capital gain / loss can be avoided.

One of the key considerations for determining whether your cryptocurrency is a personal use asset is the length of time you keep hold of it before using it to buy something. The longer you keep hold of it, the less likely it is to be considered a personal use asset. While the guidance is a little vague, some examples provided by the ATO indicate that if transactions take place within a 2 week period then they may be considered as personal use assets.

However, crypto assets are not personal use assets when you keep or use them:

Finally, donating crypto to a registered charity is also one of the few times that it is not taxable.

You can claim capital losses on cryptocurrency investments to offset capital gains. If you sell cryptocurrency at a loss, you can use this loss to reduce your overall tax liability. Capital losses can’t, however, be used to offset income.

It’s fair to say that crypto tax in Australia is complex. That’s why it pays to get advice from accounting experts. It’s crucial to maintain accurate records of all your cryptocurrency transactions, including purchase/sale dates, amounts, and the parties involved. This information is necessary for tax reporting. It’s advisable to report all cryptocurrency transactions accurately and seek professional tax advice to ensure compliance with tax laws.

The Small Business Technology Investment Boost by the ATO, is a tax incentive program designed to provide financial support to small businesses seeking to invest in technology to improve their operations and productivity. The scheme allows eligible businesses to claim an additional 20% tax deduction for technology-based expenses up to a threshold.

For an entity to be eligible for the boost it must be “carrying on a business” with an aggregated annual turnover of less than $50 million. The boost can apply to sole traders, partnerships, companies, and trusts.

Business expenses that have a close connection with the entity’s digital operations or digitising its operations are eligible for the bonus deduction. As the legislation is very broad in its definition a large variety of expenses may be eligible.

The bonus deduction for the boost will be taken up by us as a tax adjustment when we prepare the 2023 Income Tax Returns. The 2023 Income Tax Returns will include the tax adjustment for eligible expenses incurred during the 2023 financial year, as well as eligible expenses incurred during the eligible period within the 2022 financial year (29 March 2022 to 30 June 2022).

The boost is capped at $100,000 of expenditure per income year, resulting in a bonus deduction of $20,000. Therefore, since the eligible period covers one full financial year (2023) and part of another financial year (2022), the total bonus deduction claimable is $40,000.

For further details on the Small Business Technology Investment Boost please click on this Australian Tax Office link.

Please contact the team at MGI if you have any questions or require further information.

The ATO has recently indicated its intention to more closely focus on those involved in the sharing economy. The introduction of the Sharing Economy Reporting Regime from July 1st, means that digital platforms involved in short term accommodation or taxi travel are required to provide the ATO with details of seller transactions. With so many Australians now involved in these services, it’s vital that you understand sharing economy tax requirements. So if you operate an Airbnb or provide ridesharing services, there are a few key things you should pay attention to.

The sharing economy refers to a business model where individuals or businesses share their resources, skills, or services with others through digital platforms. Examples of the sharing economy in Australia include:

The platforms through which you provide sharing economy services may ask you for more information to meet their obligations under the Sharing Economy Reporting Regime (SERR) including:

1. Goods and Services Tax (GST): If you are registered or required to be registered for GST and your annual turnover from the sharing economy exceeds the GST threshold (as at August 2023, the threshold is $75,000), you need to account for and remit GST on your services or sales. However, the GST registration threshold may change over time, so it’s essential to check the current threshold with the ATO.

2. Income Tax: Any income earned from sharing economy activities is generally considered assessable income for tax purposes. This means you must report your earnings from platforms like Airbnb, Uber, or Airtasker in your annual income tax return. Keep records of your earnings and expenses related to the sharing economy activities to accurately report your income.

3. Capital Gains Tax: If you rent out all or part of your home, you will no longer be able to claim the full capital gains tax (CGT) main residence exemption. Instead, you’ll pay capital gains tax on the sale proceeds according to the portion of the property that you have rented out.

As a participant in the sharing economy, you may be eligible for tax deductions on expenses related to your business activities. Common deductions may include:

1. Vehicle expenses: If you use your vehicle for ride-sharing or delivery services (e.g., Uber), you may be able to claim deductions for fuel, maintenance, registration, insurance, and depreciation.

2. Home expenses: If you rent out part of your home on platforms like Airbnb, you can claim a portion of your home-related expenses, such as utilities, internet, and cleaning.

3. Equipment and tools: If you use specific equipment or tools for your sharing economy activities, you may be able to claim deductions for their costs and maintenance.

4. Service-related expenses: You may also claim deductions for expenses related to providing your services, such as cleaning supplies or materials required for a task on Airtasker.

It’s crucial to keep accurate records of all your income and expenses to substantiate your claims during tax time. Additionally, the tax implications and deductions may differ for businesses or individuals with unique circumstances, so it’s always best to seek advice from a qualified tax professional.

The tax accountants and business advisors at MGI South Queensland can help you understand what your tax obligations are and if you are entitled to any deductions. Contact us now on 07 3002 4800 to get the latest advice.