Subscribe for Our Latest Resources

"*" indicates required fields

The Australian Taxation Office (ATO) has recently released an updated set of small business benchmarks based on 2022-23 financial year data. The benchmarks are reviewed annually and broken down into 100 industries and they’re used by the ATO to assess whether a business might be under-reporting taxable income and over-claiming deductions.

The ATO provides Small Business Benchmarks as a tool to help businesses compare their financial performance against industry standards. These benchmarks are derived from data collected from tax returns and activity statements of businesses across various industries. They serve as a guide for businesses to assess their performance and ensure they are meeting their tax obligations.

The ATO uses these benchmarks to identify businesses that may be avoiding their tax obligations. By comparing a business’s financial ratios to industry standards, the ATO can detect anomalies that may indicate underreporting of income or overstatement of expenses. Businesses that fall significantly outside the benchmark ranges may attract scrutiny and potential audits.

However, they can also be a useful tool for any business to compare your performance, including turnover and expenses against others in your industry. You might be able to identify opportunities to make improvements to your business.

The benchmarks cover 100 industries and over 2 million small businesses around the country. The industries include:

What If Your Business Falls Outside the Industry Benchmarks?

You might find that your business falls outside of these benchmarks. If you’re above or below the standards for your industry it doesn’t necessarily mean you’ve done anything wrong however, it’s an indicator that it’s worth reviewing your business plan.

ATO Assistant Commissioner Tony Goding said: “While we never use the benchmarks in isolation, small businesses who fall outside the ATO’s benchmarks are more likely to trigger a closer examination from us to identify if they are making mistakes or deliberately doing the wrong thing.”

If your business’s expenses are higher than the industry average, it may suggest that your expenses are high relative to sales. This might show that your:

Such discrepancies can trigger ATO reviews or audits to ensure compliance.

Conversely, if your expenses are significantly lower than the industry average, it might indicate that:

While being below the benchmark isn’t inherently negative, it’s essential to ensure that all expenses and obligations are accurately reported.

Understanding where your business stands in relation to the ATO Small Business Benchmarks is crucial. Regularly comparing your financial ratios to industry standards can help identify areas for improvement and ensure compliance with tax obligations. It also aids in making informed business decisions and maintaining financial health.

At MGI South Qld, we specialise in business performance analysis and helping businesses navigate the complexities of tax compliance and financial performance. Our team can assist you in:

Contact us today to ensure your business aligns with industry benchmarks and maintains robust financial health.

Every quarter the Australian Taxation Office (ATO) shares their areas of focus when it comes to small businesses meeting their tax and superannuation obligations. These insights help businesses remain compliant with tax obligations and avoid costly penalties. As we enter the final quarter of the 2024/25 financial year, the ATO has announced three key focus areas for small business owners to be aware of. These include undeclared contractor income, suggested changes in GST reporting frequency and compliance with small business boost measures. Staying informed and aligned with the ATO small business focus areas can help you avoid ATO scrutiny and maintain good standing with the tax office.

As part of the taxable payments reporting system (TPRS), businesses must report payments made to contractors for providing the following services.

If you work as a contractor and provide any of these services, the business you contract to will report those payments to the ATO on their TPAR and you need to include this income on your tax return. Contractors need to be aware that the ATO is using sophisticated data matching techniques to identify contractors reported through the TPRS. This quarter, the ATO will be increasing its scrutiny on contractors who:

To remain compliant, contractors should ensure all income is accurately declared in their small business tax returns. The ATO uses data-matching technology to detect discrepancies between reported income and what is actually received.

From March 2025, the ATO is encouraging more small businesses to transition from quarterly to monthly BAS (Business Activity Statement) reporting for GST purposes. If you have a history of failing to comply with your tax and GST obligations you may receive communication from the ATO notifying you of your new monthly reporting cycle effective from 1 April 2025. You are more likely to be migrated to the new reporting cycle if you have not responded to previous communications from the tax office and demonstrate a poor compliance history, for example:

The aim is to help businesses:

While not mandatory for all small businesses, monthly GST reporting is highly recommended for businesses that frequently receive GST refunds or are struggling with quarterly reporting accuracy. The ATO is focusing on educating and assisting businesses with this transition during Q4.

If you’re considering switching to monthly GST reporting, speak with your accountant or advisor to determine if it’s the right move for your business.

The ATO continues to monitor compliance with the recently introduced small business boost measures, which were designed to support digital adoption and skill development. These include:

The ATO is actively reviewing claims to ensure they meet eligibility requirements. Key risks include:

Among the main errors being reported for the Skills & Training Boost program include:

To remain compliant, ensure your claims are accurate, well-documented, and within the guidelines set out by the ATO.

The ATO will also continue to focus on non-commercial business losses, small business capital gains tax (CGT) concessions, business income is not personal income and GST registration and income of taxi, limousine and ride-sourcing services.

Staying compliant with ATO small business benchmarks and requirements doesn’t need to be overwhelming. By understanding the ATO’s focus areas and keeping your tax records and obligations in check, you can reduce risk and focus on growing your business.

At MGI South Qld, we help small businesses stay on top of their tax administration and compliance requirements. If you’re unsure about your income declarations, GST reporting obligations or small business boost claims, our team is here to support you.

Contact us today to stay ahead of ATO updates and ensure your business remains compliant for Q4 and beyond.

The general transfer balance cap is set to increase to $2 million on 1 July 2025, following the release of quarterly CPI data.

With all groups CPI figure reaching 139.4 for the December 2024 quarter, the general transfer balance cap will be indexed for the 2025–26 year, increasing to $2 million from $1.9 million.

The cap limits the amount of money that can be transferred into the retirement phase in super. The increase means clients commencing their first retirement phase income stream in 2025–26 will start with a personal transfer balance cap of $2 million.

Clients who already have a personal transfer balance cap that they have not fully utilised at any time in the past will see their cap increase on 1 July 2025 by a smaller amount due to proportional indexation.

This increase also affects other superannuation rules and concessions including the total superannuation balance, which will also increase to $2 million.

A member’s total super balance at 30 June 2025 will need to be less than $2 million for them to access the standard non-concessional contributions cap.

The 3-year bring forward rule will be limited against a higher Total Superannuation Balance as per below:

To 30 June 2025

From 1 July 2025

If you have any queries or concerns or need further advice and support about superannuation changes please don’t hesitate to reach out to the team at MGI.

Not for profit entities that aren’t registered charities are now required to complete an annual Not For Profit Self Review return.

The NFP self-review return due date is approaching. For all NFP’s who have yet to lodge a return with a 30 June 2024 year end the new lodgement date is 31 March 2025.

Non-charitable NFPs with an active Australian business number (ABN) must lodge the return to confirm their eligibility for income tax exemption.

However, an entity that has a different year end date, will need to apply to the ATO to adopt a Substituted Accounting Period (SAP) and be approved.

SAPs may be granted to NFPs where they can demonstrate that an ongoing event, industry practice, business driver or other ongoing circumstance makes 30 June an inappropriate or impractical balance date.

For more information on lodgement due dates and substituted accounting periods please see link: ATO Lodgement Dates

Various categories of NFPs will not be included in the new return and will not have a lodgement obligation.

However, if your NFP falls into the below category it will need to self-assess and lodge a return with the ATO:

Any NFP’s who do not meet the above categories but are either one of the following are considered exempt from lodging the return:

The not-for-profit (NFP) self-review reporting is arguably the largest change in this sector since the establishment of the Australian Charities and Not-for-Profit Commission (ACNC) in late 2012. It is important to note that no changes have been made to the legislation allowing entities to self-assess their income tax exempt status. Every organisation that has been appropriately self-assessing its status the Income Tax Assessment Act 1997 will remain eligible to self-assess for the income tax exemption from 1 July 2024.

The new requirement asks these organisations to formally report the specific basis of their assessment, by reference to the category of organisation and the specific eligibility criteria that apply to that category.

It has always been a requirement that these organisations review their eligibility to self-assess for the income tax exemption on an ongoing basis and now it will be a requirement that this assessment is lodged with the Australian Taxation Office (ATO).

We note that there is no requirement to provide detailed financial information outside of disclosing a revenue band into which the organisation falls, which allows the population to be dissected on the basis of size in the future.

For those organisations already identified by the ATO, the return will be automatically generated. It will show on the entity’s ‘For action’ page in Online services for business (OSB), which may help identify the requirement for some organisations that lodge periodic activity statements via this method. Tax or BAS agents who assist with meeting GST obligations may be well-placed to identify.

Call to Action

As the Not For Profit self review return reporting regime is relatively new, we would suggest the following actions:

Should you have any questions or wish to discuss this matter further, please do not hesitate to contact our office.

The Lord Mayor’s Women in Business Grant will provide funding to support women-owned businesses to grow and develop. Eligible businesses can apply for a grant of up to $5,000 (excluding GST) to build their business capability and also boost local economic impact.

This Women In Business grant opportunity has already opened and applications close at 4pm on 14 October 2024.

Eligibility Criteria:

More information can be found on the Brisbane Business Hub but don’t hesitate to contact the team at MGI for any assistance.

The Business Basics grant program provides support to businesses to increase core skills and adopt best practice. This round of Business Basics (Round 6) is focused on business enhancement. The program is administered by the Department of Employment, Small Business and Training (DESBT).

This program is applicable for businesses with less than 5 employees and a turnover of less than $300,000. With increased funding to $7500, start planning your registration of interest in the latest round of small business grants, Business Basics. Applicants can apply for funding for grant funded activities under the following priorities:

1. Professional business advice

2. Strategic marketing services

3. Website build/upgrades

Opening Date: Registration of Interest (ROI) opens at 9am, Monday 30 September 2024.

Closing Date: Stage 1: Registration of Interest (ROI) closes at 5pm, Friday 11 October 2024

Access to supporting documentation and eligibility criteria is available on the Queensland Government Business website.

Please reach out to the team at MGI, if you need support in preparing your application.

For small businesses to enhance their efficiency and productivity.

This support includes funded activities in 3 project areas:

Available Funding:

Stage 1 is open (registration of interest)

Closes on Friday 5th of July at 5.00pm

More information on eligibility and the application process can be found here.

Don’t hesitate to reach out to MGI if you have any questions or need assistance to complete the application.

At the recent 2024 Australian Accounting Awards, MGI Australasia was awarded the Network of the Year Award for our outstanding commitment to supporting our clients in achieving ‘Success Your Way’.

As a proud member of the MGI Australasia network, spanning across Australia and New Zealand, MGI South Queensland’s involvement in this network makes us a stronger firm, allowing us to work with fellow member firms to ensure we are at the forefront of our knowledge and understanding of the latest changes to our industry. This allows us to continue to provide accurate and expert advice to our clients. Our involvement in this network also allows us to provide training and development to our team, so we can continue the incredible work of MGI South Queensland for years to come.

Some other benefits within the MGI Australasia network include; The Graduate Academy, MGI Australasia Future Leaders Conference, MGI Australasia Leaders Conference, MGI Australasia Tax Seminar, MGI Australasia Annual Conference, plus our sub-committees and our connection to the MGI Worldwide International Network.

The value of membership with MGI Australasia extends to the entire teams of all the member firms, allowing them to feel connected to other like-minded professionals across Australia and New Zealand as well as around the world.

We would like to thank all of our clients and staff for your support. We are incredibly proud of what we have achieved as a network and we look forward to continuing to build on our offering and continuing to support you in achieving your success. Also, thank you to Accountants Daily, the judging panel for this prestigious award.

As the 2024 end of tax year approaches, the Australian Tax Office (ATO) is sharpening its focus on several key areas to ensure compliance and integrity within the tax system. This year, the ATO is particularly vigilant about claims for rental property deductions, work-related expenses, and undeclared income from the sharing economy. If you’re preparing for tax time, understanding and ensuring you’re fully compliant in these areas can help ensure you get your lodgment right the first time. Let’s take a look at the ATO focus areas for 2024 in a bit more detail.

Investment properties were a firm focus at tax time in 2023 and the ATO continues to scrutinise rental property deductions closely, ensuring that claims are legitimate and accurately reflect expenses incurred. Recent audits from the tax office indicate that 90% of rental property owners are getting their tax returns wrong.

According to ATO Assistant Commissioner, Robert Thomson: “People aren’t apportioning correctly between interest relating to private use and the interest that relates to the income they’re generating from their investment property.”

Common areas where taxpayers might encounter issues include:

The ATO employs sophisticated data-matching techniques and collaborations with financial institutions to identify discrepancies and ensure compliance. Rental property owners should maintain detailed records and seek professional advice to ensure their claims are accurate and justifiable.

Work-related expenses are another area under the ATO’s microscope. This was another key focus from last year that remains a priority for the ATO. Changes were made last year to the fixed rate method of calculating a working from home deduction and taxpayers were required to keep more detailed documentation. However, this is the first full year of these changes being in effect so the expectation is that you must have comprehensive records to substantiate your claims.

“Copying and pasting your working from home claim from last year may be tempting, but this will likely mean we will be contacting you for a ‘please explain’. Your deductions will be disallowed if you’re not eligible or you don’t keep the right records.” Mr Thomson said.

To avoid issues, taxpayers should adhere to the following guidelines:

Accurate record-keeping and adherence to ATO guidelines are essential to ensure compliance and avoid audits or penalties.

The rise of the sharing economy has introduced new challenges for tax compliance. Platforms like Airbnb, Uber, and various freelancing sites have made it easier for individuals to earn income that may go undeclared.

The ATO is particularly focused on:

The ATO collaborates with sharing economy platforms to access data and identify undeclared income. These sophisticated data matching systems mean that if you decide to not report your income from these platforms then you are much more likely to trigger a review by the ATO. Participants in the sharing economy should maintain comprehensive records of their earnings and report them accurately to avoid penalties.

The advice is also to not rush to submit your tax return, particularly if you received income from multiple sources. “By lodging in early July, you are doubling your chances of having your tax return flagged as incorrect by the ATO.”

As the ATO intensifies its focus on rental property deductions, work-related expenses, and undeclared income from the sharing economy, it is more important than ever for taxpayers to be diligent and compliant. By understanding these key areas and maintaining accurate records, taxpayers can navigate their obligations confidently and avoid the risk of audits and penalties. If in doubt, seeking professional advice from the tax experts at MGI can provide the necessary guidance to ensure compliance and peace of mind in the 2024 tax year.

Check out our recent blog on Personal Services Income (PSI) to ensure that you are categorising your business and services correctly.

For more information or personalised advice on your tax obligations, feel free to reach out to the experts at MGI South Qld. We’re here to help you navigate the complexities of the Australian tax system with ease and confidence.

You might also be interested in our most recent blog on the ATO small business focus areas for Q4 of the 2024/25 financial year.

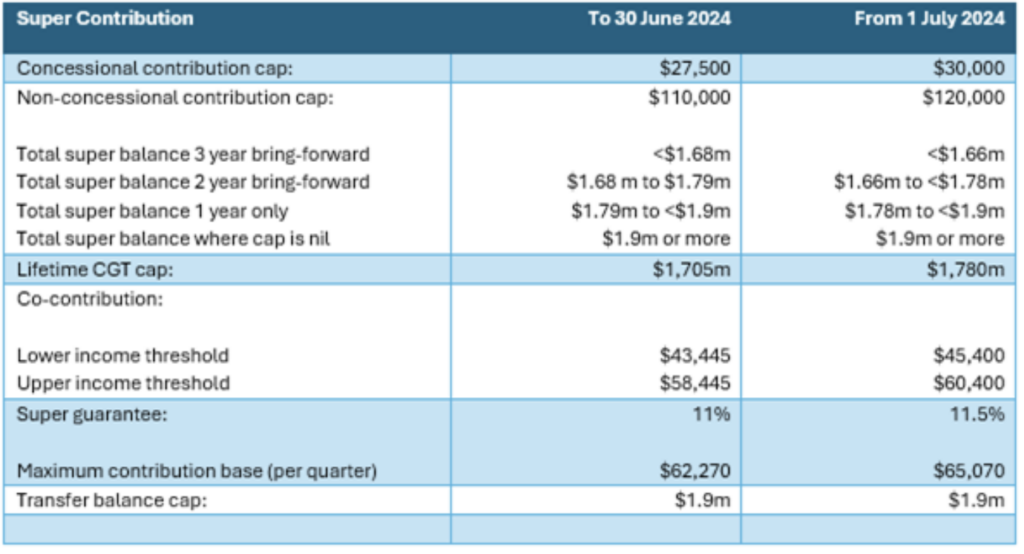

Following on from our post a couple of months ago about tax and superannuation deadlines the following are the upcoming contribution cap and superannuation changes.

1. Contributions – cap increase

From 1 July 2024 a number of rates and thresholds will increase, including the contribution caps. There has been no further indexing of the transfer balance cap so there will be changes to the eligibility to use the 3 year bring forward non-concessional contributions (see table below).

A reminder to review any salary sacrifice agreements to avoid excess concessional contributions with the increase in super guarantee to 11.5% from 1 July 2024.

2. Defined benefit interest (CSS/PSS) calculation for Division 296 – in relation to superannuation balances above $3million

From 1 July 2025 tax concessions will be reduced for certain earnings for superannuation balances above $3 million. On 28 February 2023, the Australian Government announced from 1 July 2025 a 30% concessional tax rate will be applied to future earnings for superannuation balances above $3 million, known as Division 296.

If you are wondering how the balance of your CSS or PSS pension will be calculated for the purposes of the proposed Division 296 tax you will need to wait a little longer.

While draft legislation has been released, the calculations for determining the balance of defined pensions will be contained in the regulations which no one has seen (or possible written).

3. Reminder about the changes in Small Business Super Clearing House

From 15 March 2024, the ATO will introduce SMSF bank account validation in the Small Business Superannuation Clearing House (SBSCH). This will require any small employer using the SBSCH to ensure that their employees’ SMSF bank accounts match the bank account details registered with the ATO for contributions.

If you are receiving contributions via SBSCH or using the SBSCH to pay employer contributions, it is important to contact employees to confirm that the SMSF bank account that superannuation contributions are paid to, is the same as the SMSF bank account registered against the superannuation role, with the ATO. A mismatch will mean that their superannuation contributions can’t be processed through the SBSCH.

This also applies for any member roll-in and roll-out requests.

Please contact us if you need to check the details of the bank account registered with the ATO for your SMSF.

Proactive steps are essential to ensure any SG obligations for the March 2024 quarter can be met by 28 April 2024.

4. Non-Arm’s Length Income/Expense (NALI/NALE) Bill Passed Through Parliament

An important reminder to the trustees and the members of the fund, that NALI/NALE bill has now passed through both houses of Parliament and it is essential to review all general expenses incurred/not-incurred within the fund.

It is crucial to understand and review transactions within the superfund that there is no expenditure at non-arm’s length that will trigger the rules concerning non-arm’s length income.

This rule specifically dives into general expenses such as discounted accounting or adviser fees, legal fees or any other general expenses which are non-arm’s length.

If you have any queries or concerns or need further advice and support about superannuation changes please don’t hesitate to reach out to the team at MGI.