Subscribe for Our Latest Resources

"*" indicates required fields

Are you losing staff due to higher alternative salary rates on offer in the market? Then offering performance based rewards will assist you to retain staff and improve your bottom line!

Research indicates Generation Y has high earnings expectations and wants rewards based on performance. To implement an effective performance based rewards program, your staff needs to have input and agree to what is expected of them (“deliverables”).

Establish the deliverables for both individuals and team positions. These can include a range of quantitative (objective) and qualitative (subjective) assessment criteria. Once the deliverables are agreed, you will apply a weighting to each criteria. This will depend on the strategic and operational objectives of your business (grow sales, new customers, better productivity etc). A staff member’s result determines the amount of their performance bonus. The more they deliver the higher their rewards. It’s a win for both owners and their staff.

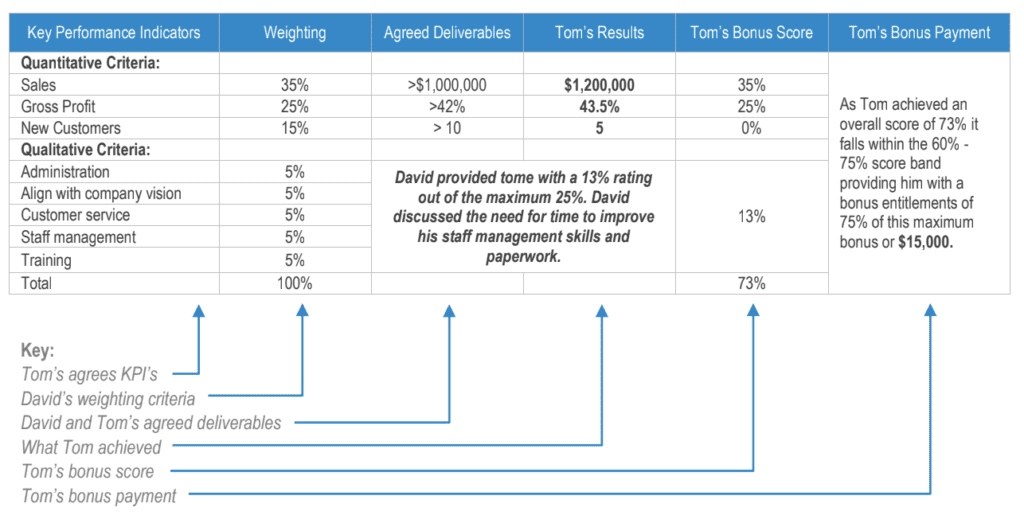

David needs to grow sales and improve profitability. David’s concern is his staff costs are increasing and profits are declining. He has now implemented the Staff Value Program and agreed to pay Tom, a key staff member, a maximum bonus of $20,000. The payment of the bonus is conditional upon Tom meeting specific performance targets. Below is his bonus score card.

The qualitative assessment process allows business owners to assess the achievements of their staff and the criteria are measurable by observation. It provides a proactive approach for addressing subjective performance matters that are otherwise usually left unresolved.

Once the Staff Value Program is implemented by your business, you then need to ensure you have the systems and procedures in place to measure your staff’s performance on a timely basis. As performance bonuses are paid as a result of exceeding budgeted profits, business owners are beginning to realise they can compete with apparently higher alternative salary rates on offer in the market and retain their staff by paying a sufficient bonus based on performance.

The business advisory team at MGI have specialists who have helped businesses like yours develop a performance based reward program. A business coach from MGI can help you to implement a similar scheme and help improve your staff retention. We always have a clear focus on managing costs and improving profitability. We offer expert business growth support and can also assist with business benchmarking and analysis to ensure your business remains competitive.

You’ve grown your business gradually and now your minds turn to collecting your reward from your investment capital, know-how, and years of effort. Achieving the most for your business requires the same diligence it took grow it. This is where having a business succession plan becomes vital.

Developing a effective plan for business succession is the key protecting, growing and realising the maximum value for your business. It is a strategic process that allows you to smoothly transition the ownership and/or management for your business.

Research shows that business value can be impacted by a number of issues including:

Times change, markets change, and so does the business environment. Not long ago, business entry costs and competitive forces were lower and business growth could be funded by borrowing against increasing house prices.

Business success demands focus by you on the operation, but ultimately, issues of success and retirement will creep up. By then, getting the price you need could be elusive.

The next generation of business owners, Generation Y, face a completely different business environment. Start-up and acquisition costs are higher, regulatory barriers are higher, and competition has increased. Business funding opportunities are also more limited in comparison.

You’re a business owner and you understand the driving forces behind competition, supply and demand.

So when do you need to start developing a plan for business succession?

Thus, it is important for you to start planning your succession now. Talk to the business advisory team at MGI about our succession planning services and let us help you start the process. We can help you benchmark your business against others in the market, strategic planning planning, wealth management and business valuations.

You might also be interested in our previous blog about business exit strategy.

It’s usually easier to look back after a business has failed and identify why, than it is to save a struggling business from failing in the first place. In my view there are a number of reasons for this, not the least of which is the fact that everyone is always wiser with the benefit of hindsight.

However, it begs the question of what a business owner can do if their business is struggling? After all, they have a lot of their heart and soul invested into the business (as well as their capital). It’s their “baby” and they are convinced they’re onto a winner, even if it isn’t working out.

The answer is – it depends. It depends on many variables including what type of business they’re in, what industry it’s in, where it’s located and what size the business is and what stage it is at in its lifecycle. In my experience, scale can often play a huge part. There are many struggling business owners out there – some might call them micro businesses.

But there is hope. Here are my top four tips to get your business back on track.

When I walk past retail outlets (clothing shops for example), I often wonder if the owner knows how many (or what dollar value) of clothes they must sell each and every day in order to simply breakeven.

One thing many businesses fail to do before even setting up business is a simple breakeven analysis. A business broadly has two types of costs – fixed and variable. As the name suggests, fixed costs are largely fixed in nature. This means you’ll have to pay these whether you sell one item or one million. Whilst all costs are variable over time, rent might reasonably be regarded as a fixed cost. You will have this cost even if no customers walk in the door.

Variable costs are simply those that vary with your sales volume. If you are a wholesaler or retailer, the cost of your product might be a variable cost.

So, tip number one would be to understand your breakeven sales point (on a yearly basis) and then break this down to a daily or weekly basis i.e. how many items do you have to sell each day or each week. Then develop and implement strategies to help you sell more than this quantity.

A struggling business might be able to grow its way out of trouble, but do you have the necessary cash to fund that growth? Do you know how much cash you’ll need to fund your desired growth?

In order to answer that question you need to know one critical measure – your working capital burn rate. If you don’t know this you’re flying blind. I often see businesses targeting a certain percentage increase in sales. When I ask them how much working capital they’ll need to fund that growth they often don’t know. Sales generally don’t fund themselves.

For some businesses their working capital burn rate can be quite high. These businesses will struggle to fund rapid growth. For others it can be quite low, in which case they will have an easier road.

You need to know yours.

Every business has what I call financial drivers. If you don’t know yours you may as well be driving a car without an instrument panel on your dashboard. You don’t know how much fuel you have, whether your engine is overheating or whether your oil is getting low. It’s the same with your business.

Various businesses respond differently to a given intervention. In other words, some businesses are volume driven – they perform better the more goods they sell. Others are margin driven – they don’t necessarily need to grow at the same rate, but they make more profit on the items they sell. Once again, how your business responds will depend on a number of factors including the current size of your business and your breakeven level.

Some businesses require large amounts of working capital e.g. stock and debtors, and can therefore respond well to small improvements in working capital management. Others may have what is called a lazy balance sheet, with a number of underperforming assets.

The key is to understand your key financial drivers – changes in these areas will give you the biggest bang for your buck and potentially turnaround a struggling business.

Finally, you need to focus on my one key measure of financial performance. In my view, this is Return on Capital Employed (ROCE). Understand how much capital you have invested in your business and focus on deriving an acceptable return on that.

If your ROCE is not acceptable, you’ll know where to focus your attention.

The answer is usually there somewhere. You just need to know where to look.

Often business owners let their heart rule their head but unless they remember that they also have capital invested in the business and act in a mercenary way, they could end up with a broken heart and zero capital.

If you would benefit from support for your struggling business, we have a number of specialist business advisors who can help with business benchmarking, business growth and business funding. Contact us today for a coffee and an informal chat.