We have put together a summary from our recent Webinar covering PCG2021/4 and Wealth Structuring for Paediatric Dentists with the help of our presenters Alice Wu – Associate Director of MGI and Jaxon King – Managing Director of Scion Private Wealth.

PCG 2021/4: Staying in the Green Zone for the 2025–2026 Financial Year

What is PCG 2021/4?

PCG 2021/4 is a Practical Compliance Guideline issued by the Australian Taxation Office (ATO). It outlines how the ATO assesses the allocation of profits within professional firms, especially where income is distributed through structures like trusts, partnerships, or companies. It applies to individual professional practitioners (IPPs)—such as directors, partners, or shareholders—who derive income from professional services firms.

Who Does It Apply To?

This guideline is relevant for:

- Professional firms (e.g., legal, accounting, medical, dental)

- IPPs receiving income from these firms

- Structures involving non-PSI income (i.e., not personal services income)

Why Is It Important for 2025–2026?

The ATO has confirmed that PCG 2021/4 remains in effect for the 2025–2026 financial year. Staying within the green zone (low risk) is essential because it:

- Minimizes the chance of ATO audits

- Ensures compliance with tax law

- Protects against anti-avoidance provisions

- Supports ethical and commercially sound practices

Risk Assessment Framework

Before scoring your arrangement, you must pass two gateways:

- Commercial Rationale – Is the structure commercially justified?

- No High-Risk Features – Avoid artificial income splitting or dividend access shares

Then, assess your arrangement using up to three risk factors:

- Proportion of profit returned to the IPP

- Effective tax rate paid by the IPP

- Appropriate remuneration for services

Example: Vinnie the Paediatric Dentist

Vinnie runs his dental practice through a company owned by the Wen Family Trust. He’s entitled to $400,000 in total income.

- $200,000 paid to Vinnie as salary

- $200,000 paid as a franked dividend to the Wen Family Trust:

- $150,000 to his spouse, Debbie

- $50,000 to a related investment entity

This setup scores 8, placing Vinnie in the amber zone (medium risk). Because his market salary is hard to benchmark, only two risk factors are assessed.

However, if Vinnie adjusts the distribution so that 60% of the income stays in his name, his score drops to 7, moving him into the green zone—a much safer position.

Tips to Stay in the Green Zone

- Review your structure annually

- Document your rationale and distributions

- Avoid high-risk features

- Use the ATO’s risk scoring tool

- Seek professional tax advice

For any questions about this topic, please contact Alice Wu on (07) 3002 4800 or email awu@mgisq.com.au

Turning Business Profit Into Personal Wealth: A Guide for Dentists

How specialist dental professionals can structure their wealth and invest strategically to turn today’s business income into tomorrow’s financial freedom.

Running a successful dental practice – particularly in specialist areas like paediatric dentistry – comes with more than just high income. You face unique challenges: complex income structures, specialist equipment costs, staff obligations and potential litigation risks.

While compliance with PCG 2021/4 is essential for meeting tax obligations, it’s what you do with that income afterward that defines your long-term financial success. In this article, we explore the strategies discussed in our recent AAPD webinar, turning expert insights into practical advice to help you turn tax-smart profits into lasting personal wealth.

The Three Pillars of Enduring Wealth

At Scion Private Wealth, we use a proven framework to guide our high-income clients:

1. Structure – Protect, Distribute & Grow

- Protect your assets with smart ownership strategies and the right insurances.

- Distribute income efficiently to reduce unnecessary tax.

- Grow your wealth by putting idle cash to work.

2. Strategy – Make Money Work Harder Than You Do

- Avoid generic advice. Instead, build a personalised investment and wealth plan aligned with your career stage and family goals.

3. Succession – Plan Ahead for Life Beyond the Practice

- Many dentists overlook this. Whether you’re years away or nearing retirement, succession planning ensures you exit on your terms and leave a legacy – not a mess.

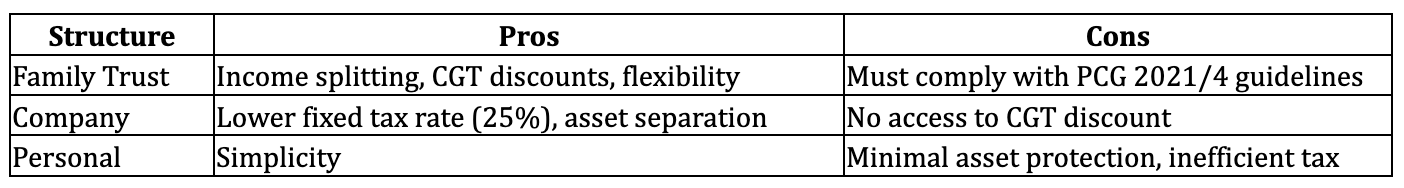

Choosing the Right Wealth Structure

Dentists need asset protection and tax efficiency. Here’s how different structures compare:

Best Practice: Use a combination – e.g., a company to operate the practice, a service trust for income splitting and a family trust to distribute profits tax-effectively.

PCG 2021/4: Don’t Be Discouraged by Compliance

The ATO’s guidelines around income allocation don’t eliminate trusts- they just raise the bar for consistency and evidence.

To stay in the green zone:

- Document beneficiary arrangements

- Align debt appropriately

- Ensure commercial arrangements (e.g., service fees) are well supported

Case in Point: Dr Sarah, a paediatric dentist, restructured her trust for compliance while using excess profits to fund a family investment company for her children’s future.

Protecting Your Assets: A Must for Dentists

Dentistry is a high-liability profession. Lawsuits, staff disputes, or even property leases can place personal wealth at risk.

Asset Protection Strategies:

- Hold personal assets in your spouse’s name or a trust

- Avoid acting as trustee of your own trust

- Use a “bucket company” to retain profits tax-effectively

- Keep business and personal finances strictly separate

Creating Passive Income Streams

When structured well, surplus profits can fund assets that pay you – even while you sleep.

Options to Consider:

- Managed Investments – ETF portfolios, index funds, or diversified strategies tailored to your career stage

- Property – Understand the differences between residential and commercial property from a yield and liability perspective

- Dividend Stocks – Build income through equities via your personal or trust account

Dr James invested $100K annually into global healthcare and infrastructure funds. Five years later, his portfolio now generates $32,000 in passive income annually.

Superannuation: Your Underrated Wealth Vehicle

Super can be a secret weapon for dentists- especially as high-income earners facing top marginal tax rates.

Key Tips:

- Maximise concessional contributions (15% tax vs up to 47%)

- Use catch-up contributions if you have unused caps

- Consider spouse contributions or super splitting

- Stay updated: 2025 changes include indexed caps and new balance thresholds

Building Intergenerational Wealth

Your personal wealth journey can also support the next generation.

Tax-Efficient Options for building intergenerational wealth:

- Education Bonds – 10-year tax-effective saving tool for children’s schooling

- Family Investment Companies – Consolidate and compound wealth over time

- Testamentary Trusts – Protect inheritances from relationship breakdowns and financial immaturity

Succession Planning: Don’t Leave It Too Late

Many dentists delay practice succession planning until it’s too late—or worse, sell without a strategy.

Exit Pathways:

- Internal Buy-In – Bring in a junior partner over time

- External Sale – Prepare for valuation negotiations with corporates

- Keep the Property – Generate passive income post-sale

Dr Helen gradually transitioned her practice to a junior dentist, retained the clinic’s building, and now earns $60K per year in rental income while mentoring part-time.

Let Business Profit Fund Life Goals

Your practice should support your life – not the other way around.

Use surplus income to:

- Fund family holidays and sabbaticals

- Pay for private school or university

- Save for a holiday home or investment property

- Retire earlier (or at least have the choice)

“You’ve built a great practice. Now it’s time to build a great life.”

Final Thoughts: Time to Act

Too many high-income professionals leave wealth to chance. A strategic, tailored approach can mean the difference between a busy working life and a truly wealthy one.

Key Takeaways:

- Wealth structure is just as important as wealth creation

- Asset protection and tax efficiency should be foundational

- Passive income and strategic investments create freedom

- Succession needs to start years before you plan to exit

Ready to Align Your Wealth With Your Vision?

Let’s explore how your business success can fund your long-term lifestyle goals.

For any questions about this topic, please contact Jaxon King on (07) 3778 6800 or email jking@scionprivatewealth.com.au.

Scion Private Wealth is a trusted advisor of MGI.