When most people think of Self Managed Super Funds (SMSFs), they invariably have visions of a grey-haired older couple looking forward to their retirement. Rarely, I suspect, do we imagine younger people in their thirties, forties and dare I say it – twenties. However, that perception is no longer the reality if recent ATO statistics on SMSFs are any indication.

So why do the younger generations increasingly have such an interest in SMSFs?

First, let’s look at the data.

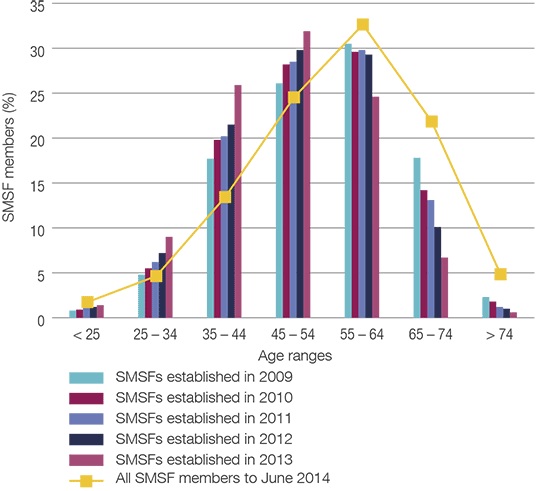

The recent ATO December 2014 quarterly report, as well as the 2013 annual report, showed a continuing trend for members of new SMSFs to be from younger age groups than those of the total SMSF member population. As at June 2014 the bulk of members of SMSF’s were still those aged 45 and over (around 80%), but there is a growing trend of new funds being established by those aged 25 to 45.

For the first time ever, the median age of SMSF members of newly established funds decreased to less than 50 years (in 2013). In addition, of the SMSFs established in 2009, 49% of members were under 55 years old. This compares to 68% of members of SMSFs established in 2013 – which represents a huge change in just four years.

Not surprisingly the graph below shows an increasing trend of SMSF’s being established by up to age 54 and a reducing trend of SMSF’s being established by those aged 55 and over. So it appears that Gen X’s and Gen Y’s are slowly catching up with their parents.

Proportion of SMSF members by age range

ATO Graph: Proportion of SMSF members by age range

Source: ATO “Self-managed superannuation funds: A statistical overview 2012-2013”

Now let’s look at some of the facts in detail.

Firstly, let’s look at Gen Y’s, or those roughly born between 1980 and 1995, meaning they would be aged between 18 and 33 when the survey data was collated. In 2009, only about 5% of SMSF’s were established by those aged 25 to 34. In 2013, the figure had almost doubled to 9%.

Let’s now look at Gen X’s, generally considered to be those born between 1961 and 1979, meaning they would be aged between 34 and 52 in 2013. Over the same period, those aged 35 to 44 established around 18% of SMSF’s in 2009. In 2013, this figure is around 26%.

Combined, SMSF’s established by 25 to 45 year olds has increased from around 22% to around 35% – a 50% increase.

This begs the natural question –why?

In my view I think there are a number of reasons for this.

Firstly, I think it is clear that in recent years the financial planning industry has not covered itself in glory, with a series of collapses, debacles and complaints of vested interest. In a nutshell, I believe that the industry has lost the trust of a large part of the population, including those with super.

Secondly, I think there is a perception (certainly since the GFC) that DIY’ers can invest their funds just as well as the fund managers. This perception may not be the reality, but I do feel this is driving some of the decision making. Regardless, there may be a perception of being “bullet proof” and that “even if I lose my money, I still have time to re-build it before I retire”.

I think a further reason is that we now live in a digital age and Gen X and Y have grown up in this digital age. As such, information and the ability to DIY are much easier than it was for baby boomers. However, whilst information is more readily available, information is not the same as wisdom. Baby boomers probably tended to rely on the wisdom of their traditional trusted adviser.

So, how can Gen X’s and Y’s get the most out of their SMSF?

One tip is to ensure they have enough super in the first place to make it cost effective. The cost of administering a fund can vary, but given that most of the administration needs to be done regardless of whether you’ve got $1 or $1m, it makes sense to ensure you have enough to make it worthwhile. Some estimates suggest you need at least $200,000 to make it worthwhile; however this depends on a number of factors including how quickly you intend to build up your super or whether you’re intending to borrow and buy a property.

The desire to buy a property through an SMSF is often a reason why people want to establish their own SMSF. They can rollover their super from their existing industry or retail fund into their own SMSF and use the funds to buy an investment property. However, it is important to bear in mind that you can’t buy a beach house or ski chalet and then use it yourself. Business premises are okay though and offer particular advantages for those who operate their own business.

Another benefit is in developing your own share portfolio. Most companies pay dividends and these will generally be franked dividends, meaning tax has been paid by the company at the rate of 30%. Super funds are only taxed at 15%, so the balance of the franking credits are available as a tax refund to the fund or can be used to offset other tax payable by the fund.

Organising your life insurance through your super fund is also something you can do. By having the fund own the policy and paying the premiums through the fund you are effectively getting a tax deduction for the premiums by way of the super fund contributions.

However, there are also traps to be aware of and those setting up their own fund need to be aware of what they can and can’t do. Penalties for breaching the super laws can be significant. Some that SMSF trustees should be aware of include:

Limits on amounts that can be contributed to the fund.

Restrictions on investments in related parties (called in-house assets).

Restrictions of acquiring assets from members or associates.

Restrictions on borrowings of the fund.

It is important to seek professional advice before setting up your own fund.

MGI has an established track record for helping people to maximise the opportunities which superannuation benefits present. Speak to an MGI expert today for up to the minute advice on the right superannuation investment strategy for you. Call us on 3002 4800 to book an appointment or for further discussion with a superannuation adviser.

MGI refers to one or more of the independent member firms of the MGI international alliance of independent auditing, accounting and consulting firms. Each MGI firm in Australasia is a separate legal entity and has no liability for another Australasian or international member’s acts or omissions. MGI is a brand name for the MGI Australasian network and for each of the MGI member firms worldwide. Liability limited by a scheme approved under Professional Standards Legislation.