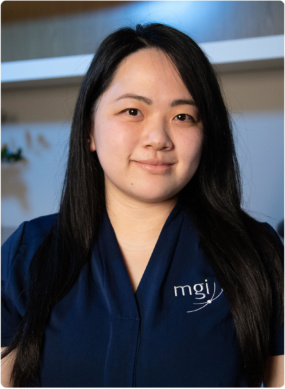

“MGI has a great understanding of charities. For them to be able to educate us on how to run our charity, enabled us to feel confident moving forward.” -Lianne Evans, Farmer Support, Drought Angels.

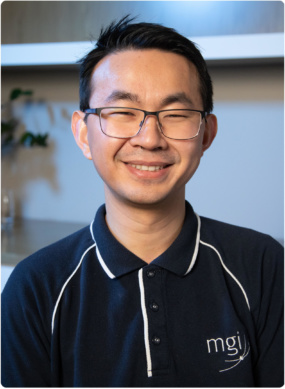

“The charitable and not for profit sector is highly regulated and specialised so it’s important that NFP organisations source accountants and auditors that have proven experience in this space, as the legislation can be a minefield.” – Steve Greene, Director, Audit and External CFO Services.

“My experience with MGI has been phenomenal! They immerse themselves in the business. They come here to us, which has been absolutely critical for us. That’s MGI’s point of difference.” – Angela Holland, Farmer Support Team Leader, Drought Angels.

“I would recommend MGI to anybody! They have just been wonderful, easy to deal with, so professional and efficient. Their knowledge, that they’ve been able to share with us based around charities, that’s been invaluable!” – Natasha Johnston, Co-Founder and Director, Drought Angels.

With the current drought being amongst the worst the country has ever seen, Drought Angels is a charity that was set up to support the primary producer community in rural Australia. Having experienced rapid growth over the last couple of years, the team turned to MGI to help ensure they had the right accounting and auditing processes in place and help them grow even further.